1100 ETH: A Comprehensive Overview

Are you considering investing in Ethereum (ETH) but feel overwhelmed by the vast amount of information available? Look no further! In this article, we will delve into the details of 1100 ETH, exploring its potential, risks, and the factors that influence its value. By the end, you’ll have a clearer understanding of what 1100 ETH represents and how it fits into the broader cryptocurrency landscape.

Understanding Ethereum

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. The native cryptocurrency of the Ethereum network is ETH, which is used to pay for transaction fees and to incentivize network participants.

The Value of 1100 ETH

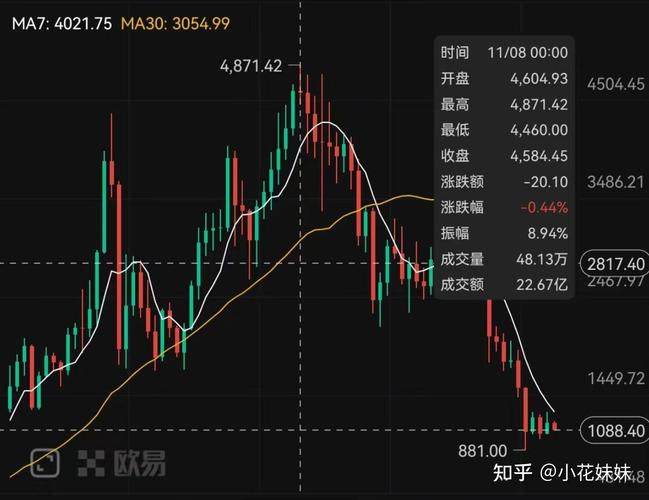

As of the time of writing, the value of 1100 ETH can vary significantly depending on the current market conditions. To give you an idea, let’s take a look at the historical price of ETH:

| Year | Price per ETH |

|---|---|

| 2015 | $0.30 |

| 2016 | $10.00 |

| 2017 | $1,200.00 |

| 2018 | $300.00 |

| 2019 | $150.00 |

| 2020 | $600.00 |

| 2021 | $4,000.00 |

| 2022 | $2,000.00 |

Based on this data, 1100 ETH could be worth anywhere from $1,100 to $2,200, depending on the current market price. However, it’s important to note that cryptocurrency markets are highly volatile, and prices can fluctuate rapidly.

Factors Influencing ETH Value

Several factors can influence the value of ETH, including:

-

Supply and demand: The total supply of ETH is capped at 18 million coins, which makes it a deflationary asset. As the demand for ETH increases, its value may rise.

-

Network activity: The more active the Ethereum network is, the higher the demand for ETH. This is because users need to pay for transaction fees in ETH.

-

Market sentiment: The overall sentiment in the cryptocurrency market can greatly impact ETH’s value. Positive news, such as new partnerships or technological advancements, can drive up the price, while negative news can lead to a decline.

-

Regulatory news: Changes in regulations can have a significant impact on the value of ETH. For example, if a country bans cryptocurrencies, it could lead to a decrease in demand and a drop in price.

Risks Associated with Investing in ETH

While investing in ETH can be lucrative, it’s important to be aware of the risks involved:

-

Market volatility: Cryptocurrency markets are known for their extreme volatility. Prices can skyrocket, but they can also plummet rapidly.

-

Security risks: As with any digital asset, there is a risk of theft or loss due to hacks or human error.

-

Lack of regulation: The cryptocurrency market is still relatively new and lacks comprehensive regulation, which can make it difficult to predict market trends and protect investors.

How to Invest in 1100 ETH

Investing in 1100 ETH involves several steps:

-

Choose a cryptocurrency exchange: Research and select a reputable cryptocurrency exchange that supports