20,744.42 ETH: A Comprehensive Overview

When it comes to cryptocurrencies, Ethereum (ETH) has emerged as one of the most popular and influential digital assets. With a market capitalization that often places it among the top three cryptocurrencies, owning 20,744.42 ETH can be a significant achievement. In this article, we will delve into various aspects of this substantial ETH holding, including its value, potential growth, risks, and practical applications.

Market Value of 20,744.42 ETH

The current market value of 20,744.42 ETH can be calculated by multiplying the current ETH price by the number of ETH you own. As of the time of writing, let’s assume the price of ETH is $2,000. Here’s how you can calculate the market value:

| ETH Price | Number of ETH | Market Value |

|---|---|---|

| $2,000 | 20,744.42 | $41,488,840 |

As you can see, owning 20,744.42 ETH at a price of $2,000 per ETH is worth approximately $41,488,840. This value can fluctuate significantly based on market conditions and the price of ETH.

Potential Growth of ETH

Ethereum has seen substantial growth since its inception in 2015. The potential for further growth depends on various factors, including technological advancements, regulatory developments, and market demand. Here are some key factors that could contribute to the growth of ETH:

-

ETH 2.0 Upgrade: The transition to Ethereum 2.0, which includes improvements such as proof-of-stake consensus and sharding, is expected to enhance the network’s scalability and efficiency. This could attract more users and investors, potentially increasing the value of ETH.

-

Decentralized Finance (DeFi): DeFi has gained significant traction in the Ethereum ecosystem, with numerous projects leveraging the platform for various financial applications. As DeFi continues to grow, the demand for ETH as a transactional currency may increase.

-

Smart Contracts: Ethereum’s smart contract functionality has enabled the development of decentralized applications (dApps) and other innovative projects. As more developers adopt Ethereum for their projects, the demand for ETH may rise.

Risks Associated with Owning ETH

While owning 20,744.42 ETH can be a lucrative investment, it’s essential to be aware of the risks involved:

-

Market Volatility: Cryptocurrency markets are known for their volatility, and ETH is no exception. The value of your ETH holdings can fluctuate significantly in a short period, which can be both beneficial and detrimental.

-

Regulatory Risks: Governments around the world are still figuring out how to regulate cryptocurrencies. Changes in regulations could impact the market value of ETH and its adoption.

-

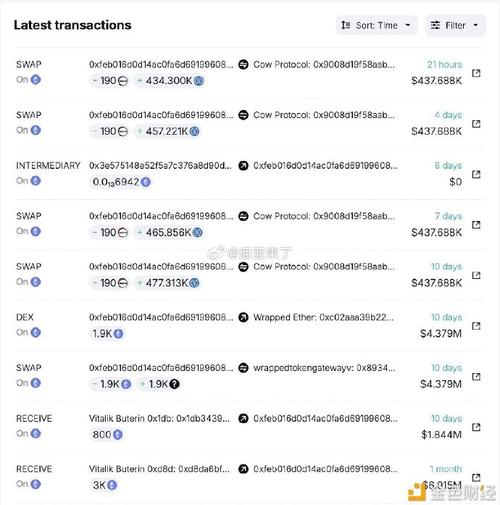

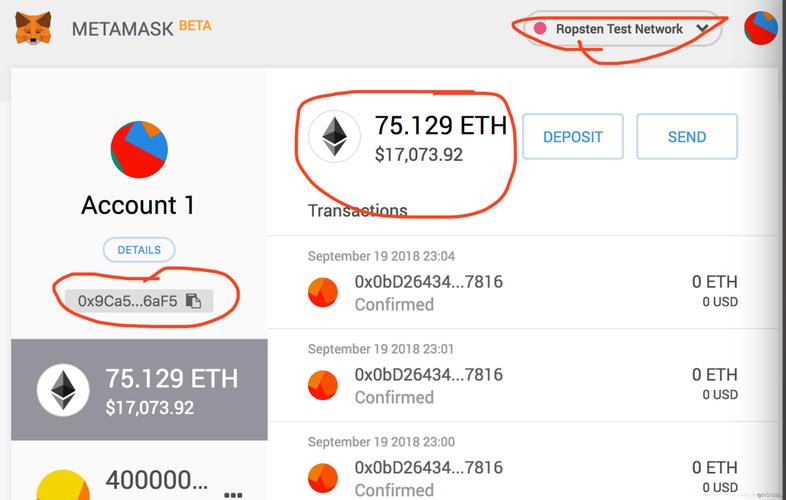

Security Risks: As with any digital asset, there are security risks associated with storing and transferring ETH. It’s crucial to use secure wallets and follow best practices to protect your holdings.

Practical Applications of ETH

Ethereum offers a wide range of practical applications beyond just investment. Here are some of the most notable uses of ETH:

-

Smart Contracts: As mentioned earlier, smart contracts are a key feature of Ethereum. They enable the creation of decentralized applications, which can range from simple contracts to complex financial instruments.

-

Tokenization: ETH can be used to tokenize various assets, such as real estate, stocks, and bonds. This allows for easier trading and liquidity of these assets.

-

Decentralized Finance (DeFi): As mentioned earlier, DeFi projects often use ETH as a transactional currency. This includes lending, borrowing, and trading platforms that operate on the