002 ETH: A Comprehensive Guide to Understanding Ethereum and Its Token

Have you ever wondered what 002 ETH stands for? In this article, we will delve into the world of Ethereum, its token, and how they both play a significant role in the blockchain ecosystem. Whether you are a beginner or an experienced investor, this guide will provide you with a comprehensive understanding of 002 ETH.

What is Ethereum?

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). It was created by Vitalik Buterin in 2013 and launched in 2015. Unlike Bitcoin, which is primarily a digital currency, Ethereum is a platform that allows for the creation of various decentralized applications.

Ethereum operates on a blockchain, which is a distributed ledger technology that ensures transparency, security, and immutability. The blockchain consists of a chain of blocks, each containing a set of transactions. These blocks are linked together in a chronological order, making it nearly impossible to alter or delete any transaction once it is added to the blockchain.

What is 002 ETH?

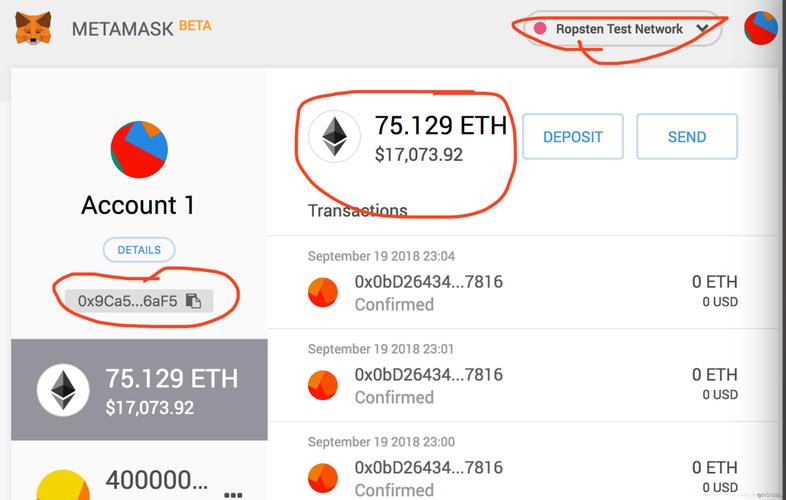

002 ETH refers to the native cryptocurrency of the Ethereum network. It is often abbreviated as ETH. ETH serves as the primary currency within the Ethereum ecosystem and is used to pay for transaction fees, operate smart contracts, and participate in the network’s governance.

ETH is a digital asset that can be bought, sold, and traded on various cryptocurrency exchanges. It is also used as a medium of exchange for goods and services within the Ethereum network. The supply of ETH is capped at 18 million coins, making it a deflationary asset.

How to Obtain 002 ETH?

There are several ways to obtain 002 ETH:

-

Buying ETH on a cryptocurrency exchange: You can purchase ETH using fiat currency (e.g., USD, EUR) or other cryptocurrencies (e.g., BTC, LTC). Some popular exchanges include Coinbase, Binance, and Kraken.

-

Staking ETH: Staking is a process where you lock up your ETH in a wallet and earn rewards in return. Staking is a way to secure the network and validate transactions.

-

Participating in an Initial Coin Offering (ICO): An ICO is a fundraising event where a new cryptocurrency is offered to the public in exchange for ETH or other cryptocurrencies. However, ICOs are risky and should be approached with caution.

-

Mining ETH: Mining is the process of validating transactions on the Ethereum network and earning ETH in return. However, mining requires specialized hardware and electricity, making it an expensive endeavor.

Understanding Ethereum’s Tokenomics

Tokenomics refers to the economic model of a cryptocurrency, including its supply, distribution, and utility. Here’s a breakdown of Ethereum’s tokenomics:

| Token Supply | 18 million ETH |

|---|---|

| Token Distribution | 42% to early investors, 58% to community |

| Token Utility | Payment for transaction fees, operating smart contracts, and participating in governance |

The Role of 002 ETH in the Ethereum Ecosystem

002 ETH plays a crucial role in the Ethereum ecosystem:

-

Transaction Fees: When you send ETH or interact with a smart contract, you need to pay a transaction fee. This fee is paid in ETH and helps maintain the network’s security and efficiency.

-

Smart Contracts: ETH is used to deploy and operate smart contracts on the Ethereum network. Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

-

Network Governance: ETH holders can participate in Ethereum’s governance by voting on important decisions, such as protocol upgrades and changes to the network’s parameters.

The Future of 002 ETH

The future of 002 ETH is uncertain, but there are several factors that could impact its value:

-

Adoption of Ethereum: As more businesses and developers adopt Ethereum for their DApps, the demand for ETH may increase, potentially driving up its value.

-

Protocol