Understanding ETH: A Comprehensive Guide

ETH, short for Ethereum, is a groundbreaking blockchain platform that has revolutionized the way we think about digital currencies and decentralized applications. As you delve into the world of ETH, it’s essential to understand its various dimensions. Let’s explore the intricacies of ETH in this detailed guide.

What is Ethereum (ETH)?

Ethereum is an open-source, decentralized blockchain platform that enables the creation and execution of smart contracts. It was launched in 2015 and has since become one of the most popular blockchain platforms in the world. ETH, the native cryptocurrency of Ethereum, serves as a medium of exchange and a unit of account within the network.

The Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is a decentralized computing engine that executes smart contracts on the Ethereum network. It allows developers to build and deploy decentralized applications (dApps) that run on the blockchain. The EVM is a key component of Ethereum, as it ensures that smart contracts are executed in a secure and predictable manner.

Smart Contracts: The Building Blocks of Ethereum

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically enforce and execute the terms of an agreement when predetermined conditions are met. This eliminates the need for intermediaries, such as lawyers or brokers, and reduces transaction costs. Smart contracts have paved the way for innovative applications in various industries, including finance, real estate, and supply chain management.

The Ethereum Network

The Ethereum network is a decentralized network of nodes that run the Ethereum software. These nodes validate transactions and maintain the blockchain. The network is secured through a consensus mechanism called Proof of Work (PoW), where miners compete to solve complex mathematical puzzles to add new blocks to the blockchain. This process ensures the security and integrity of the network.

ETH: The Native Cryptocurrency of Ethereum

ETH is the native cryptocurrency of the Ethereum network. It serves as a medium of exchange, a unit of account, and a store of value. ETH can be used to pay for transaction fees, participate in governance, and access various decentralized applications. The supply of ETH is capped at 18 million coins, making it a deflationary asset.

The Ethereum Community

The Ethereum community is one of the most active and engaged in the blockchain space. It consists of developers, investors, and enthusiasts who are passionate about the potential of Ethereum. The community drives innovation, development, and adoption of Ethereum-based technologies.

Ethereum 2.0: The Future of Ethereum

Ethereum 2.0 is a major upgrade to the Ethereum network that aims to improve scalability, security, and sustainability. The upgrade includes the transition from Proof of Work (PoW) to Proof of Stake (PoS), which will reduce energy consumption and increase network efficiency. Ethereum 2.0 also introduces a new consensus mechanism called Casper, which will improve the overall performance of the network.

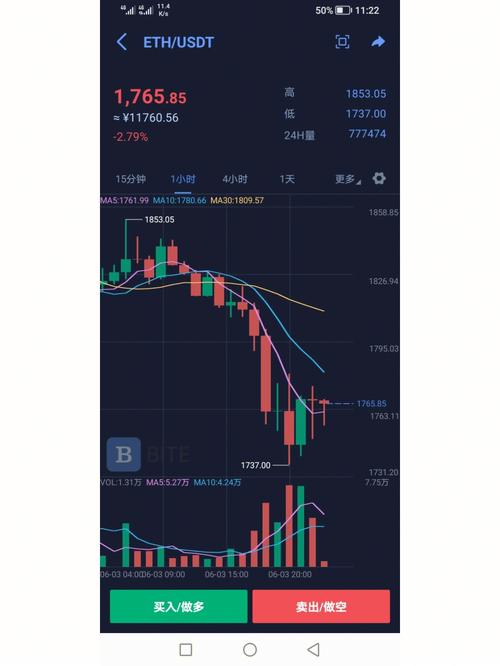

ETH Price and Market Dynamics

The price of ETH has experienced significant volatility over the years. It reached an all-time high of nearly $5,000 in 2021, but has since experienced a correction. The price of ETH is influenced by various factors, including market sentiment, regulatory news, and technological advancements. As you invest in ETH, it’s crucial to stay informed about the market dynamics and make informed decisions.

ETH Use Cases

ETH has a wide range of use cases, including:

| Use Case | Description |

|---|---|

| Payment | ETH can be used to make payments for goods and services online. |

| Smart Contracts | ETH is used to pay for gas fees when executing smart contracts. |

| DeFi | ETH is used in decentralized finance (DeFi) platforms for lending, borrowing, and earning interest. |

| NFTs | ETH is used to purchase and sell non-fungible tokens (NFTs) on various marketplaces. |

| Investment | ETH can be bought and held as an investment, with the potential for long-term growth. |