Understanding the Potential of 1 ETH in 2030

As we delve into the future, the cryptocurrency market continues to evolve, and Ethereum (ETH) stands as one of the most prominent players. In this article, we will explore the potential of 1 ETH in 2030, considering various dimensions such as market trends, technological advancements, and real-world applications.

Market Trends

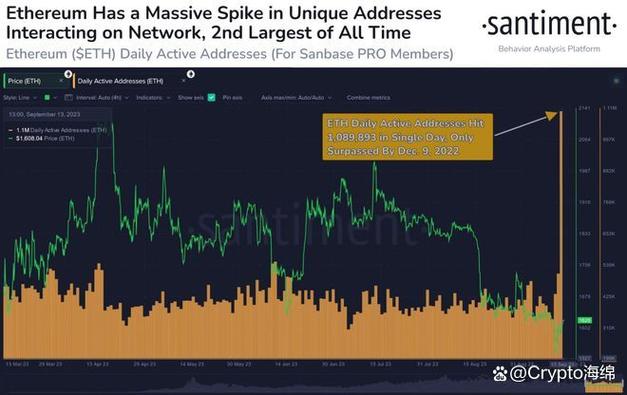

By 2030, the cryptocurrency market is expected to have matured significantly. According to a report by Grand View Research, the global cryptocurrency market size is projected to reach USD 1.7 trillion by 2025, growing at a CAGR of 6.3% from 2019 to 2025. This growth is driven by increasing adoption, regulatory frameworks, and technological advancements.

As for Ethereum, it has been a leader in the smart contract space, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms. With the Ethereum 2.0 upgrade scheduled for completion in 2022, the network is expected to become more scalable, secure, and energy-efficient. This could potentially attract more users and investors, driving the value of ETH higher.

Technological Advancements

Ethereum’s technological advancements play a crucial role in its potential growth. The Ethereum 2.0 upgrade, also known as Serenity, aims to transition the network from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. This transition is expected to reduce energy consumption and increase network scalability, making Ethereum more sustainable and efficient.

Additionally, Ethereum is exploring various layer-2 scaling solutions, such as Optimistic Rollups and zk-Rollups, to further enhance its performance. These solutions aim to increase transaction throughput and reduce gas fees, making Ethereum more accessible to a broader audience.

Real-World Applications

The real-world applications of Ethereum are vast and continue to expand. In 2030, we can expect to see Ethereum being used in various industries, including finance, healthcare, supply chain, and real estate. Here are some examples:

| Industry | Application |

|---|---|

| Finance | Decentralized exchanges, stablecoins, and cross-border payments |

| Healthcare | Electronic health records, medical research, and supply chain transparency |

| Supply Chain | Track and trace of goods, smart contracts for supply chain finance, and fraud prevention |

| Real Estate | Smart contracts for property transactions, digital identities, and title registration |

These applications are expected to drive demand for ETH, as users and businesses seek to leverage the network’s capabilities. Moreover, as more industries adopt blockchain technology, the value of ETH could increase significantly.

Regulatory Environment

The regulatory environment plays a crucial role in the growth of the cryptocurrency market. In 2030, we can expect to see more countries adopting favorable regulations for cryptocurrencies and blockchain technology. This could lead to increased adoption and investment in the market, benefiting Ethereum and other cryptocurrencies.

However, it is essential to note that regulatory uncertainty remains a concern. Governments may impose stricter regulations or even ban cryptocurrencies, which could impact the market negatively. As such, it is crucial for investors to stay informed about the regulatory landscape and make informed decisions.

Conclusion

In conclusion, the potential of 1 ETH in 2030 is substantial, considering the market trends, technological advancements, and real-world applications. With the Ethereum 2.0 upgrade, increased adoption, and a growing list of real-world applications, ETH could become a valuable asset for investors and businesses alike. However, it is essential to remain cautious and stay informed about the regulatory landscape and market dynamics.