Understanding the 5.32661937 ETH Price: A Comprehensive Overview

When it comes to cryptocurrencies, the price of Ethereum (ETH) is a topic of great interest. As of the latest data, the price of 5.32661937 ETH is a significant figure that can impact your investment decisions. In this article, we will delve into the various aspects that contribute to this price, providing you with a detailed and multi-dimensional understanding.

Market Dynamics

The price of 5.32661937 ETH is influenced by a multitude of factors, including supply and demand, market sentiment, and broader economic trends. To understand the current price, let’s take a closer look at these factors.

| Factor | Description |

|---|---|

| Supply and Demand | The price of ETH is determined by the balance between the number of people willing to buy and sell it. When demand is high, prices tend to rise, and vice versa. |

| Market Sentiment | The overall perception of the market can significantly impact prices. Positive news, such as partnerships or technological advancements, can lead to increased demand and higher prices. |

| Economic Trends | Global economic conditions, such as inflation or currency fluctuations, can also influence the price of ETH. |

Market Analysis

Understanding the current market analysis is crucial in determining the price of 5.32661937 ETH. Let’s explore some key aspects of the market analysis.

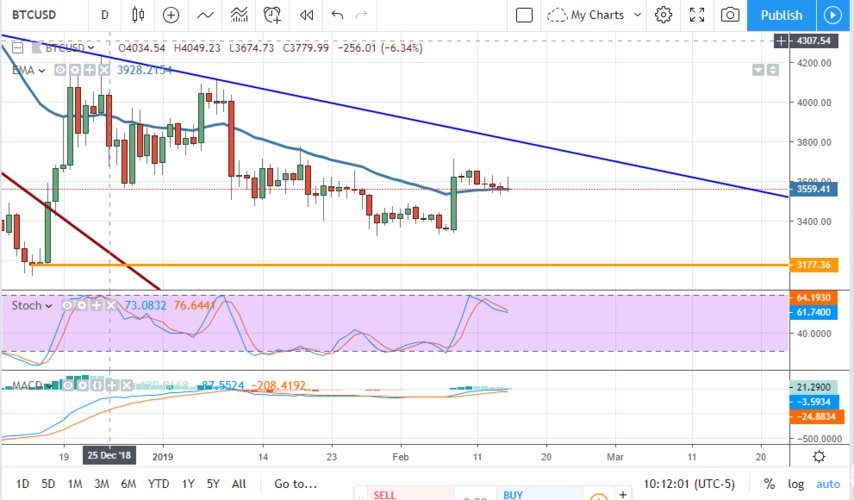

1. Historical Price Performance

Looking at the historical price performance of ETH can provide insights into its volatility and potential growth. Over the past few years, ETH has experienced significant price fluctuations, with both highs and lows. Analyzing this data can help you make more informed decisions.

2. Market Capitalization

The market capitalization of ETH is a measure of its overall value in the market. As of the latest data, the market capitalization of ETH is approximately $200 billion. This figure can give you an idea of its size and influence in the cryptocurrency market.

3. Trading Volume

The trading volume of ETH is another important factor to consider. A high trading volume indicates that there is significant interest in the asset, which can contribute to price stability and liquidity.

Technological Advancements

Technological advancements play a crucial role in the price of ETH. Let’s explore some of the key technological factors that can impact the price.

1. Ethereum 2.0

Ethereum 2.0 is a major upgrade to the Ethereum network, aimed at improving scalability, security, and sustainability. The successful implementation of Ethereum 2.0 can lead to increased demand for ETH and potentially drive up prices.

2. Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has gained significant traction in the cryptocurrency market, with many projects being built on the Ethereum network. The growth of DeFi can lead to increased demand for ETH, as it is often used as a transactional currency.

Regulatory Environment

The regulatory environment can have a significant impact on the price of ETH. Let’s explore some key regulatory factors.

1. Government Policies

Government policies, such as regulations or bans on cryptocurrencies, can influence the price of ETH. Positive policies can lead to increased demand and higher prices, while negative policies can have the opposite effect.

2. Legal Challenges

Legal challenges, such as lawsuits or investigations, can also impact the price of ETH. These challenges can create uncertainty in the market, leading to volatility and potential price fluctuations.

Conclusion

Understanding the price of 5.32661937 ETH requires a comprehensive analysis of various factors, including market dynamics, market analysis, technological advancements, and the regulatory environment. By considering these factors, you can gain a better understanding of the current price and make more informed investment decisions.