Understanding ETH: A Comprehensive Guide

ETH, short for Ethereum, has become a household name in the cryptocurrency world. As the second-largest cryptocurrency by market capitalization, ETH holds significant importance in the digital asset landscape. In this detailed guide, we will explore various aspects of ETH, including its history, functionality, use cases, and future prospects.

History of Ethereum

Ethereum was conceptualized in 2013 by Vitalik Buterin, a programmer inspired by Bitcoin. The platform was designed to be the next generation of cryptocurrency and decentralized application platform. In 2014, Ethereum was launched through an initial coin offering (ICO), marking the beginning of its journey.

Functionality of Ethereum

Ethereum is an open-source blockchain platform that enables the creation and execution of smart contracts. It uses its native cryptocurrency, Ether (ETH), as a medium of exchange and a fuel for executing smart contracts. The platform provides a decentralized virtual machine called the Ethereum Virtual Machine (EVM) to process point-to-point contracts.

Use Cases of ETH

ETH has a wide range of use cases, making it a versatile cryptocurrency. Here are some of the common use cases:

| Use Case | Description |

|---|---|

| Payment Medium | ETH can be used for online transactions or as a payment method for goods and services. |

| Smart Contracts and dApps | ETH serves as the fuel for executing smart contracts and running decentralized applications (dApps) on the Ethereum network. |

| DeFi | ETH plays a crucial role in decentralized finance (DeFi), allowing users to earn interest or borrow and lend cryptocurrencies. |

| NFT Purchases | ETH is the primary currency used for buying and selling non-fungible tokens (NFTs) in various markets. |

| Investment and Value Storage | Many individuals purchase and hold ETH as an investment, hoping for long-term value appreciation. |

| Blockchain Governance | ETH can be used as a voting token in certain Ethereum ecosystems, allowing token holders to participate in governance decisions. |

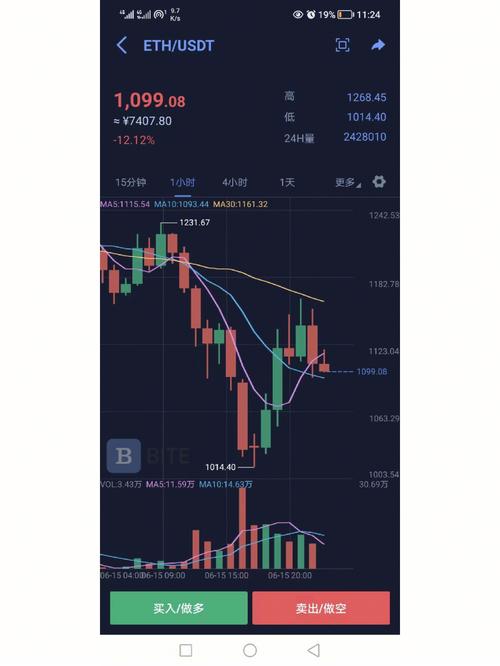

Market Performance of ETH

The market performance of ETH has been quite volatile. In January 2024, ETH successfully broke through the $2,400 resistance level, signaling a strong start to the year. The rise in ETH’s price was attributed to various factors, including increased demand, positive market sentiment, and speculation about future growth.

Future Prospects of ETH

The future prospects of ETH remain promising. With the increasing adoption of blockchain technology and the growing demand for decentralized applications, ETH is expected to continue its upward trajectory. However, it is important to note that the cryptocurrency market is highly speculative, and investors should exercise caution and conduct thorough research before making investment decisions.

Conclusion

ETH has emerged as a significant player in the cryptocurrency world, offering a wide range of functionalities and use cases. As the second-largest cryptocurrency by market capitalization, ETH holds immense potential for growth and innovation. By understanding its history, functionality, use cases, and future prospects, you can make informed decisions about your investment in ETH.