Understanding Binance ETH Interest: A Comprehensive Guide

Binance, the world’s leading cryptocurrency exchange, offers a variety of services to its users. One such service is the Binance ETH Interest, which has gained significant attention among Ethereum holders. In this article, we will delve into the details of Binance ETH Interest, exploring its features, benefits, and how it works. Whether you are a seasoned crypto trader or a beginner, this guide will provide you with all the information you need to make informed decisions.

What is Binance ETH Interest?

Binance ETH Interest is a feature that allows Ethereum holders to earn interest on their holdings. By locking up their ETH for a certain period, users can receive interest payments in Binance Coin (BNB), the native cryptocurrency of the Binance platform. This service is designed to provide a passive income opportunity for Ethereum holders, allowing them to grow their assets over time.

How Does Binance ETH Interest Work?

Participating in the Binance ETH Interest program is straightforward. Here’s a step-by-step guide on how it works:

- Log in to your Binance account.

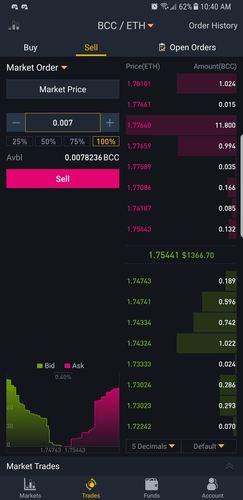

- Go to the “Funding” section and select “Binance ETH Interest” from the dropdown menu.

- Choose the interest rate and lock-up period that suits your needs. The available interest rates and lock-up periods may vary, so it’s essential to compare the options before making a decision.

- Enter the amount of ETH you wish to lock up. Keep in mind that the minimum lock-up amount may vary depending on the interest rate and lock-up period.

- Confirm the transaction and wait for the lock-up period to end. Once the lock-up period is over, you will receive the interest payments in BNB.

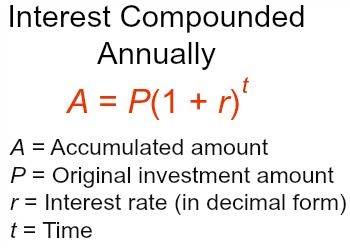

It’s important to note that the interest rate may change over time, and it is influenced by various factors, such as market demand and supply. Additionally, the interest payments are calculated based on the interest rate and the duration of the lock-up period.

Benefits of Binance ETH Interest

Participating in the Binance ETH Interest program offers several benefits:

- Passive Income: By locking up your ETH, you can earn interest payments in BNB without having to actively trade or manage your assets.

- Competitive Interest Rates: Binance offers competitive interest rates compared to other platforms, allowing you to maximize your earnings.

- BNB Rewards: The interest payments are made in BNB, which can be used for various purposes, such as trading fees discounts, participating in Binance Launchpad, or purchasing other cryptocurrencies on the platform.

- Enhanced Security: By locking up your ETH on the Binance platform, you can benefit from the robust security measures implemented by the exchange.

Risks and Considerations

While Binance ETH Interest offers several benefits, it’s important to be aware of the risks and considerations:

- Market Volatility: The value of Ethereum and BNB can be highly volatile, which may affect the overall returns on your investment.

- Lock-up Period: By locking up your ETH, you may miss out on potential price increases during the lock-up period.

- Interest Rate Changes: The interest rate may change over time, which may affect your earnings.

Comparing Binance ETH Interest with Other Platforms

When considering Binance ETH Interest, it’s essential to compare it with other platforms offering similar services. Here’s a table comparing Binance ETH Interest with other popular platforms:

| Platform | Interest Rate | Lock-up Period | Payment Currency |

|---|---|---|---|

| Binance | Varies | Varies | BNB |

| Uniswap | Varies | Varies | ETH |

| Compound | Varies |