Understanding Binance, Ethereum, and Ether: A Comprehensive Guide

Binance, Ethereum, and Ether are three of the most prominent figures in the cryptocurrency world. Whether you’re a seasoned investor or a beginner looking to dive into the crypto market, understanding these three components is crucial. In this article, we will delve into the intricacies of Binance, Ethereum, and Ether, providing you with a comprehensive guide to help you navigate the crypto landscape.

What is Binance?

Binance is a global cryptocurrency exchange that was founded in 2017 by Changpeng Zhao. It is one of the largest and most popular cryptocurrency exchanges in the world, offering a wide range of services to both retail and institutional investors. Binance provides a platform for trading various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, as well as a variety of altcoins and tokens.

One of the key features of Binance is its user-friendly interface, which makes it easy for beginners to navigate. The platform offers a range of trading options, including spot trading, margin trading, and futures trading. Binance also has a native token, Binance Coin (BNB), which can be used to pay for transaction fees on the platform.

Understanding Ethereum

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. Ethereum is built on blockchain technology, which is a decentralized ledger that records transactions across multiple computers.

The Ethereum network uses a cryptocurrency called Ether (ETH) as its native token. Ether is used to pay for transaction fees on the Ethereum network and to incentivize miners to validate transactions. Ethereum has gained popularity due to its ability to support a wide range of decentralized applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs).

Exploring Ether (ETH)

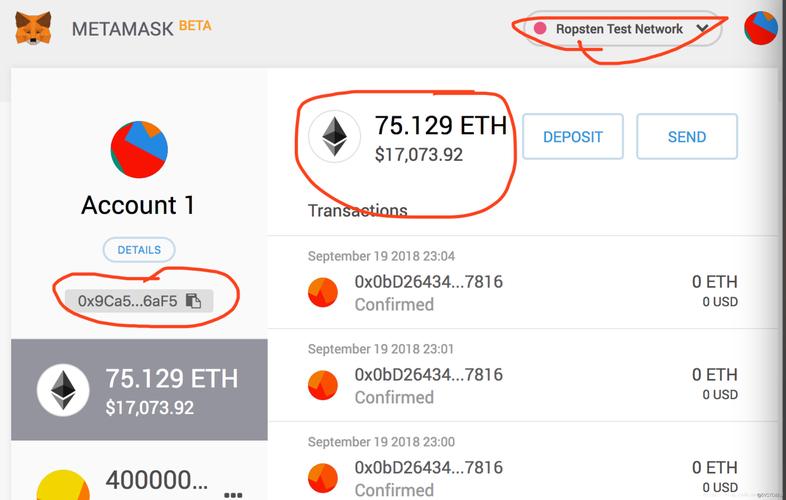

Ether is the native cryptocurrency of the Ethereum network. It is used to pay for transaction fees on the network and to incentivize miners to validate transactions. Ether is a fungible token, meaning that each unit of Ether is identical to every other unit of Ether.

One of the key features of Ether is its ability to be used as a medium of exchange. This means that you can use Ether to buy and sell goods and services online. Additionally, Ether can be used to participate in decentralized finance (DeFi) applications, which are financial applications built on the Ethereum network.

Comparing Binance, Ethereum, and Ether

Here is a table comparing Binance, Ethereum, and Ether:

| Component | Description |

|---|---|

| Binance | A global cryptocurrency exchange that offers a range of trading options, including spot trading, margin trading, and futures trading. |

| Ethereum | A decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). |

| Ether | The native cryptocurrency of the Ethereum network, used to pay for transaction fees and incentivize miners. |

Conclusion

Binance, Ethereum, and Ether are three essential components of the cryptocurrency world. Understanding these three elements can help you navigate the crypto market with confidence. Whether you’re looking to trade cryptocurrencies, develop decentralized applications, or simply learn more about the crypto landscape, this guide should provide you with a solid foundation.