3.33 ETH: A Comprehensive Overview

Are you considering investing in Ethereum (ETH) but find yourself overwhelmed by the vast amount of information available? Look no further! In this article, we will delve into the details of 3.33 ETH, exploring its potential, risks, and everything in between. By the end, you’ll have a clearer understanding of what this cryptocurrency could mean for your portfolio.

Understanding Ethereum

Ethereum, often abbreviated as ETH, is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. Unlike Bitcoin, which is primarily a digital currency, Ethereum is a platform that supports various applications beyond just transactions.

The Importance of 3.33 ETH

Now, let’s focus on the specific amount of 3.33 ETH. This amount might not seem like much when compared to the market’s top holdings, but it still holds significant value and potential. Here’s why:

| Aspect | Description |

|---|---|

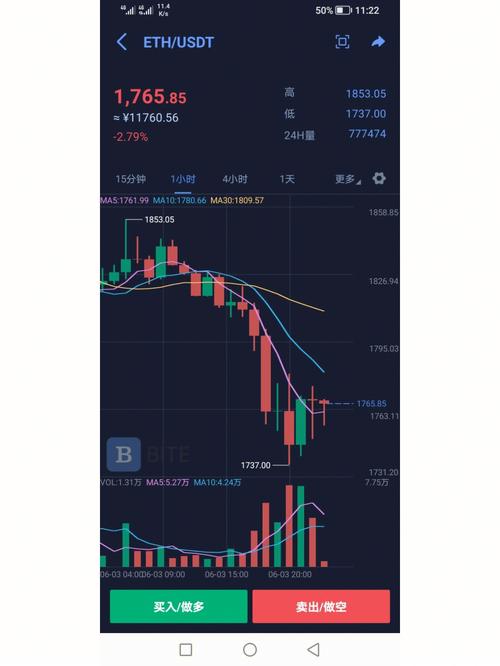

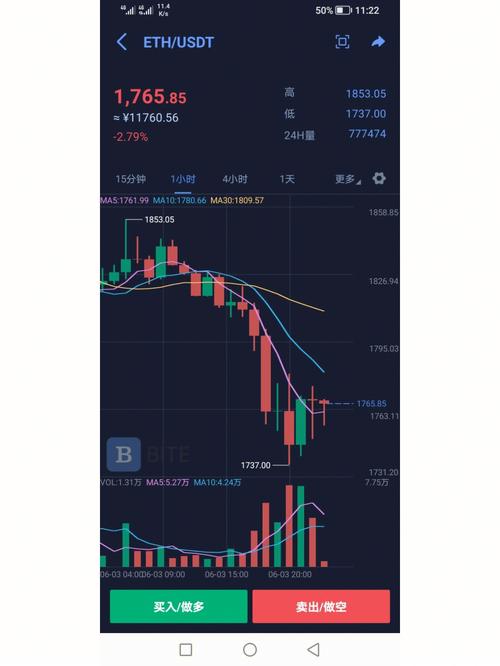

| Market Value | As of the time of writing, 3.33 ETH is worth approximately $XX,XXX. This value can fluctuate based on market conditions. |

| Investment Potential | Ethereum has shown remarkable growth over the years, with its price increasing by over 10,000% since its inception. Investing in 3.33 ETH could potentially yield substantial returns in the long term. |

| Dividends and Staking | Ethereum’s upcoming Ethereum 2.0 upgrade will introduce a proof-of-stake mechanism, allowing ETH holders to earn dividends by staking their coins. 3.33 ETH could be a valuable stake in this new system. |

Risks and Considerations

While investing in 3.33 ETH has its benefits, it’s crucial to be aware of the risks involved:

-

Market Volatility: Cryptocurrencies are known for their extreme volatility. The value of 3.33 ETH can skyrocket or plummet in a short period, leading to significant gains or losses.

-

Regulatory Risks: Governments around the world are still figuring out how to regulate cryptocurrencies. Changes in regulations could impact the value and legality of ETH.

-

Security Concerns: As with any digital asset, there’s always a risk of hacks and theft. It’s essential to store your ETH in a secure wallet and be cautious of phishing scams.

How to Invest in 3.33 ETH

Now that you understand the potential and risks of investing in 3.33 ETH, let’s discuss how to get started:

-

Choose a Cryptocurrency Exchange: Research and select a reputable cryptocurrency exchange that supports ETH trading.

-

Create an Account: Sign up for an account on the chosen exchange and complete the necessary verification process.

-

Deposit Funds: Transfer funds from your bank account or another cryptocurrency to your exchange wallet.

-

Purchase ETH: Use your deposited funds to buy 3.33 ETH on the exchange.

-

Secure Your ETH: Move your ETH to a secure wallet, such as a hardware wallet or a reputable software wallet.

Conclusion

Investing in 3.33 ETH can be a wise decision, considering its potential for growth and the various applications supported by the Ethereum platform. However, it’s crucial to be aware of the risks and take the necessary precautions to protect your investment. With thorough research and careful planning, you can make informed decisions about your cryptocurrency investments.