Understanding the Basics of ETH and BTC Charts

When it comes to investing in cryptocurrencies, understanding the charts for Ethereum (ETH) and Bitcoin (BTC) is crucial. These charts provide a visual representation of the price movements, trading volume, and other key metrics that can help you make informed investment decisions.

Price Charts: A Closer Look

Price charts are the most fundamental tool for analyzing ETH and BTC. They show the historical price of the cryptocurrency over a specific period, typically ranging from days to years. Here’s how you can interpret these charts:

-

Time Frame: The time frame of the chart can vary, from short-term minutes to long-term months. Short-term charts are useful for day traders, while long-term charts are better for long-term investors.

-

Price Movement: The price movement is represented by a line or candlestick. A rising line or candlestick indicates an increase in price, while a falling line or candlestick indicates a decrease.

-

Support and Resistance: These are key levels where the price has repeatedly struggled to move above or below. Support levels are where buyers are expected to enter the market, while resistance levels are where sellers are expected to enter.

Volume Charts: The Trading Activity Indicator

Volume charts show the trading activity of ETH and BTC. They provide insights into the number of units being bought and sold at a given price. Here’s how to read volume charts:

-

Volume Bars: The height of the volume bars represents the trading volume. A higher bar indicates higher trading activity.

-

Price and Volume Relationship: A strong correlation between price and volume suggests that the price movement is driven by real buying and selling pressure.

-

Volume Distributions: Analyzing the distribution of volume can help identify potential reversal points or continuation patterns.

Technical Indicators: Enhancing Your Analysis

Technical indicators are mathematical tools used to analyze price and volume data. They can help identify trends, patterns, and potential trading opportunities. Here are some popular technical indicators for ETH and BTC:

-

Moving Averages (MA): These indicators help identify the trend direction. For example, a rising MA indicates an uptrend, while a falling MA indicates a downtrend.

-

Relative Strength Index (RSI): This indicator measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions.

-

Bollinger Bands: These bands consist of a middle band, an upper band, and a lower band. They help identify potential overbought or oversold levels.

Understanding Market Sentiment

Market sentiment plays a significant role in the price movements of ETH and BTC. Here are some factors that can influence market sentiment:

-

News and Events: Keep an eye on news related to cryptocurrencies, such as regulatory updates, technological advancements, and major partnerships.

-

Market Trends: Analyze the overall market trends to understand the sentiment of investors. For example, a bull market indicates optimism, while a bear market indicates pessimism.

-

Social Media and Forums: Pay attention to discussions on social media platforms and forums, as they can provide insights into the sentiment of retail investors.

Creating a Trading Strategy

Once you have a good understanding of ETH and BTC charts, you can create a trading strategy. Here are some steps to help you get started:

-

Define Your Goals: Determine whether you are looking for short-term gains or long-term investment growth.

-

Analyze the Charts: Use technical analysis to identify potential entry and exit points.

-

Manage Risk: Set stop-loss and take-profit levels to minimize potential losses.

-

Stay Informed: Keep up with the latest news and market trends to adjust your strategy as needed.

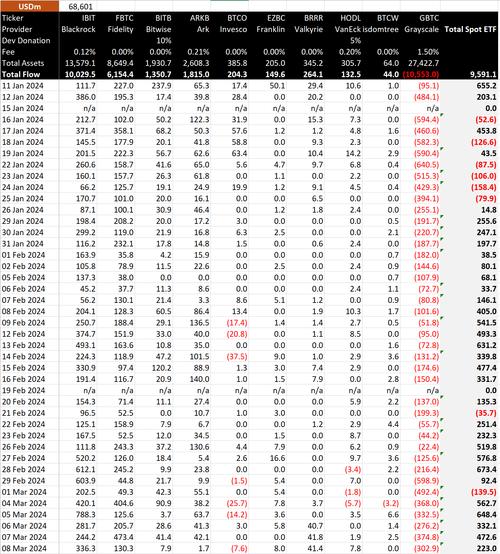

Table: Comparison of ETH and BTC Charts

| Aspect | Ethereum (ETH) | Bitcoin (

|

|---|