Eth Bull USDT: A Comprehensive Guide

Are you intrigued by the world of cryptocurrencies? Have you been considering investing in Ethereum (ETH) but are unsure about the best way to proceed? Look no further! In this article, we will delve into the details of trading ETH against the US Dollar Tether (USDT), a stablecoin that has gained immense popularity in the crypto market. By the end of this guide, you’ll have a clear understanding of what ETH bull USDT is, how it works, and why it might be the right choice for your investment strategy.

Understanding Ethereum (ETH)

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. ETH is the native cryptocurrency of the Ethereum network and is used to pay for transaction fees and to incentivize network participants.

One of the key features of Ethereum is its smart contract functionality. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. This allows for transparent, secure, and efficient transactions without the need for intermediaries.

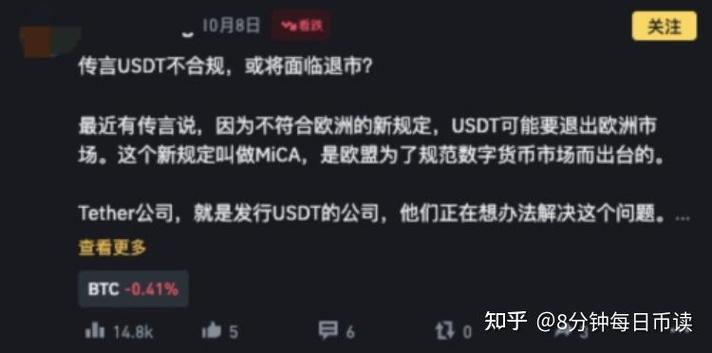

What is USDT?

USDT is a type of cryptocurrency that is backed by the US dollar. It is often referred to as a stablecoin because its value is designed to remain relatively stable compared to other cryptocurrencies, which can be highly volatile. Tether Limited, a financial services company, issues USDT and maintains a reserve of fiat currencies to back each USDT token.

USDT is popular among traders and investors because it provides a way to mitigate the risks associated with cryptocurrency volatility. By holding USDT, you can maintain a stable value while still participating in the crypto market.

Trading ETH Bull USDT

Trading ETH bull USDT involves buying ETH with the expectation that its value will increase over time, and then selling it for USDT at a higher price. Here’s a step-by-step guide to help you get started:

-

Choose a cryptocurrency exchange that supports ETH/USDT trading. Some popular options include Binance, Coinbase Pro, and Kraken.

-

Sign up for an account on the exchange and complete the necessary verification process.

-

Deposit USDT into your exchange account. You can purchase USDT with fiat currency or exchange other cryptocurrencies for USDT.

-

Use your USDT to buy ETH on the exchange. Keep an eye on the market to find the best price.

-

Once you’ve bought ETH, you can hold onto it and wait for its value to increase. When you’re ready to sell, you can exchange your ETH back for USDT.

Benefits of Trading ETH Bull USDT

There are several benefits to trading ETH bull USDT:

-

Stability: By using USDT, you can avoid the volatility associated with other cryptocurrencies, making it easier to plan your investment strategy.

-

Accessibility: USDT is widely accepted by exchanges and is often used as a medium of exchange in the crypto market.

-

Transparency: The blockchain ledger of USDT transactions is transparent, allowing you to track your investments and ensure that your funds are secure.

Risks and Considerations

While trading ETH bull USDT has its benefits, it’s important to be aware of the risks involved:

-

Market Volatility: Even though USDT is designed to be stable, the overall crypto market can still be highly volatile, affecting the value of ETH.

-

Exchange Risks: Exchanges can be hacked or suffer from technical issues, potentially leading to the loss of your funds.

-

Liquidity: The liquidity of ETH/USDT pairs can vary, which may affect your ability to buy or sell at desired prices.

Conclusion

Trading ETH bull USDT can be a lucrative investment strategy, especially for those looking to capitalize on the potential growth of Ethereum while mitigating the risks associated with cryptocurrency volatility. By understanding the basics of ETH and USDT, and by carefully considering the risks involved, you can make informed decisions and potentially achieve your investment goals.