Understanding the Power of ETH and Binance: A Comprehensive Guide for You

When it comes to the world of cryptocurrencies, two names stand out: Ethereum (ETH) and Binance. As a user, you might be curious about how these two digital assets interact and what their individual strengths are. Let’s dive into a detailed exploration of ETH and Binance, tailored specifically for you.

What is Ethereum (ETH)?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference. It’s the second-largest cryptocurrency by market capitalization, after Bitcoin.

Here’s a breakdown of what makes Ethereum unique:

- Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into lines of code. They run on a blockchain network and automatically enforce and execute the terms of an agreement.

- Decentralization: Ethereum operates on a decentralized network, meaning no single entity has control over the platform. This ensures transparency and security.

- Gas Fees: Transactions on the Ethereum network require a small amount of ETH, known as gas fees, to process. This helps maintain the network’s efficiency and security.

What is Binance?

Binance is one of the largest cryptocurrency exchanges in the world, known for its extensive range of trading pairs and advanced trading features. It was founded in 2017 by Changpeng Zhao and has since become a go-to platform for both beginners and experienced traders.

Here are some key aspects of Binance:

- Trading Pairs: Binance offers over 1,000 trading pairs, allowing users to trade a wide variety of cryptocurrencies.

- Advanced Trading Features: The platform offers various trading tools, including margin trading, futures trading, and leveraged tokens.

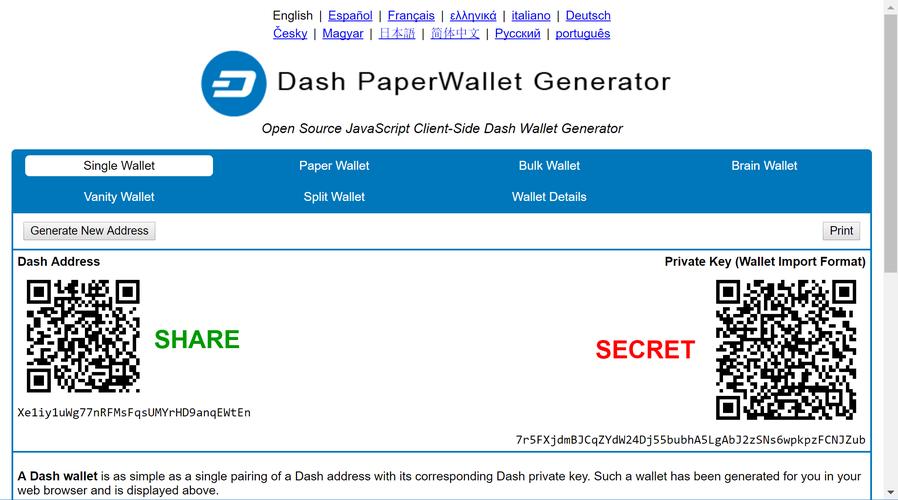

- Security: Binance has implemented multiple security measures to protect users’ assets, including cold storage for the majority of funds and two-factor authentication.

How do ETH and Binance Interact?

ETH and Binance are two distinct entities, but they are closely connected in the cryptocurrency ecosystem. Here’s how they interact:

ETH as a Payment Method:

ETH can be used to pay for goods and services on various platforms. Some online stores, websites, and applications accept ETH as a payment method, making it a versatile digital asset.

ETH as a Trading Asset:

ETH is one of the most popular cryptocurrencies for trading on Binance. Users can trade ETH against other cryptocurrencies, such as Bitcoin, Litecoin, and Binance Coin (BNB), among others.

Binance as an ETH Trading Platform:

Binance provides a platform for users to trade ETH against various other cryptocurrencies. The platform’s advanced trading features and large trading volume make it an attractive option for ETH traders.

Table: ETH and Binance Key Features

| Feature | Ethereum (ETH) | Binance |

|---|---|---|

| Market Capitalization | 2nd Largest | Not Applicable |

| Use Case | Smart Contracts, Payments | Trading, Exchanges |

| Security | Decentralized Network | Multiple Security Measures |

| Trading Volume | High | Extremely High |

Understanding the relationship between ETH and Binance can help you make informed decisions about your cryptocurrency investments and trading strategies. By knowing how these two powerful assets interact, you can leverage their combined strengths to achieve your financial goals.

Remember, the cryptocurrency market is highly volatile, and it’s essential to do thorough research and consult with a financial advisor before making any investment decisions.