Understanding the Basics

When diving into the world of cryptocurrencies, two names often stand out: Ethereum (ETH) and Bitcoin (BTC). Both are digital assets, but they differ significantly in their purpose, technology, and market dynamics. To analyze their prices, it’s crucial to understand their unique characteristics.

Bitcoin: The Digital Gold

Bitcoin, launched in 2009, is the first and most well-known cryptocurrency. It’s often referred to as “digital gold” due to its finite supply, capped at 21 million coins. Bitcoin operates on a decentralized network called the blockchain, which ensures transparency and security. Its price is influenced by factors like supply and demand, market sentiment, and macroeconomic trends.

Ethereum: The Platform for DApps

Ethereum, launched in 2015, is not just a cryptocurrency but also a platform for decentralized applications (DApps). It introduced smart contracts, allowing developers to create and deploy applications on its network. Ethereum’s native token, ETH, is used to pay for transaction fees and as a medium of exchange. Its price is influenced by the growth of the DApp ecosystem, technological advancements, and market sentiment.

Market Dynamics

Understanding the market dynamics of ETH and BTC is essential for price analysis. The cryptocurrency market is highly volatile, influenced by various factors. Here’s a breakdown of some key factors:

| Factor | Impact on ETH | Impact on BTC |

|---|---|---|

| Market Sentiment | Positive sentiment can drive up ETH prices, while negative sentiment can lead to a decline. | Similar to ETH, positive sentiment can boost BTC prices, while negative sentiment can cause a drop. |

| Regulatory News | Regulatory news can significantly impact ETH prices, as it affects the overall market sentiment. | Regulatory news can also impact BTC prices, as it affects the broader cryptocurrency market. |

| Technological Developments | Advancements in Ethereum’s technology can drive up ETH prices, while setbacks can lead to a decline. | Technological developments in Bitcoin can also impact BTC prices, but they are less frequent compared to Ethereum. |

| Macroeconomic Trends | Macroeconomic trends, such as inflation or economic downturns, can affect ETH prices. | Macroeconomic trends can also impact BTC prices, as it is often seen as a hedge against inflation. |

Price Analysis

Now, let’s delve into the price analysis of ETH and BTC. To do this, we’ll look at historical data, current market trends, and future predictions.

Historical Data

Historical data shows that both ETH and BTC have experienced significant price volatility. Bitcoin’s price has seen several bull and bear markets since its inception, with the most notable bull run occurring in 2017, when it reached an all-time high of nearly $20,000. Ethereum has also experienced rapid growth, with its price peaking at around $4,800 in 2021.

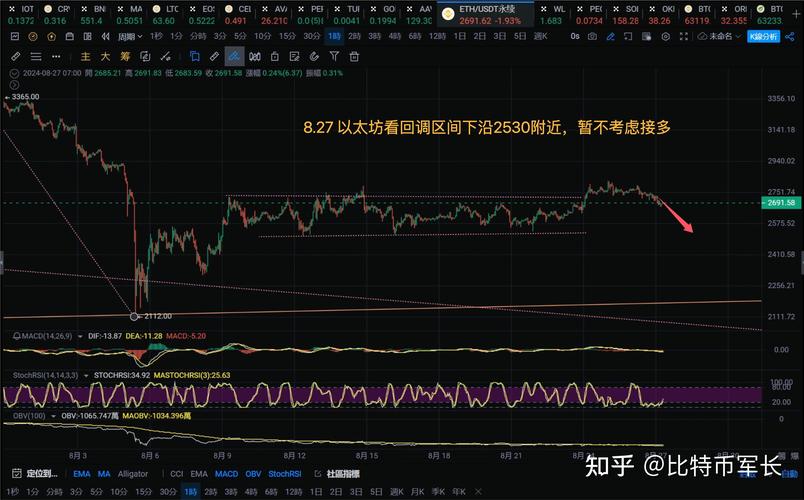

Current Market Trends

As of the latest data, Bitcoin and Ethereum are both trading at higher levels compared to their historical averages. However, the market is currently facing uncertainty due to factors like regulatory news and macroeconomic trends. Bitcoin’s price has been influenced by the Federal Reserve’s monetary policy, while Ethereum’s price has been driven by the growth of the DApp ecosystem.

Future Predictions

When it comes to future predictions, it’s essential to consider various factors. Some experts believe that Bitcoin’s price will continue to rise due to its finite supply and increasing adoption. Others argue that Ethereum’s growth potential is higher, given its role as a platform for DApps. However, it’s important to note that cryptocurrency markets are unpredictable, and future prices can be influenced by unforeseen events.

Conclusion

Understanding the price analysis of ETH and BTC requires a comprehensive understanding of their unique characteristics, market dynamics, and historical data. While both cryptocurrencies have experienced significant growth, their future prices remain uncertain. As you analyze their prices, consider various factors and stay informed about the latest market trends.