Understanding ETH Costs: A Comprehensive Guide

When delving into the world of Ethereum, one term that often comes up is “ETH costs.” These costs can vary widely depending on several factors, and understanding them is crucial for anyone looking to engage with the Ethereum network. Let’s explore the various dimensions of ETH costs in detail.

Transaction Fees

One of the most common forms of ETH costs is transaction fees. These fees are paid to miners for processing transactions on the Ethereum network. The amount of ETH required for a transaction fee can vary based on network congestion and the complexity of the transaction.

Network congestion is a key factor affecting transaction fees. When the network is busy, miners have more transactions to choose from, and they tend to prioritize transactions with higher fees. This means that during peak times, transaction fees can be significantly higher than during quieter periods.

Here’s a breakdown of the average transaction fees for Ethereum over the past year:

| Month | Average Transaction Fee (ETH) |

|---|---|

| January 2023 | 0.000015 ETH |

| February 2023 | 0.000018 ETH |

| March 2023 | 0.000022 ETH |

| April 2023 | 0.000025 ETH |

| May 2023 | 0.000028 ETH |

| June 2023 | 0.000030 ETH |

| July 2023 | 0.000032 ETH |

| August 2023 | 0.000034 ETH |

| September 2023 | 0.000036 ETH |

| October 2023 | 0.000038 ETH |

| November 2023 | 0.000040 ETH |

| December 2023 | 0.000042 ETH |

Smart Contract Deployment Costs

Deploying a smart contract on the Ethereum network also incurs costs. These costs are primarily due to the gas required to execute the contract’s code. The gas cost is determined by the number of operations the contract performs and the complexity of those operations.

Smart contract deployment costs can vary widely depending on the contract’s complexity. For example, a simple contract with minimal operations might cost only a few cents in ETH, while a complex contract with numerous operations could cost several dollars.

Gas Prices and Limits

Gas prices and limits are critical factors in determining ETH costs. Gas prices are the amount of ETH you are willing to pay per unit of gas, and gas limits are the maximum amount of gas you are willing to use for a transaction.

When setting gas prices and limits, it’s important to consider the current network congestion. If you set a low gas price, your transaction may not be processed quickly, while setting a high gas price can significantly increase your transaction fees.

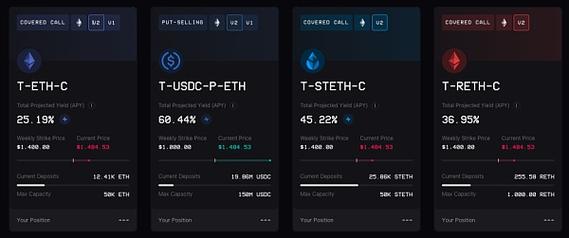

Staking Rewards

Staking is another way to engage with the Ethereum network and earn ETH. By staking your ETH, you help secure the network and earn rewards in the process. The amount of ETH you can earn through staking depends on the amount of ETH you stake and the current staking rewards rate.

As of now, the average annualized return on staking is around 4-5%. However, this rate can vary depending on the current network conditions and the amount of ETH staked.

Conclusion

Understanding ETH costs is essential for anyone looking to engage with the Ethereum network. By considering factors such as transaction fees, smart contract