Understanding ETH and USDT: A Comprehensive Guide

When it comes to the world of cryptocurrencies, two digital assets stand out: Ethereum (ETH) and Tether (USDT). Both have their unique features and play a significant role in the crypto ecosystem. In this article, we will delve into the details of ETH and USDT, exploring their origins, functionalities, and the impact they have on the market.

Origins of ETH and USDT

Ethereum, often referred to as ETH, was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. It is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). On the other hand, Tether, abbreviated as USDT, was introduced in 2014 by Tether Limited. It is a stablecoin designed to maintain a stable value by being backed by fiat currencies, primarily the US dollar.

Understanding Ethereum (ETH)

Ethereum is not just a cryptocurrency; it is a blockchain platform that supports the development of decentralized applications. Here are some key aspects of ETH:

-

Smart Contracts: Ethereum introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. This feature has enabled the creation of decentralized applications and has revolutionized the way transactions are conducted.

-

Decentralized Applications (DApps): DApps are applications that run on the Ethereum network. They are decentralized, meaning they are not controlled by any single entity. DApps can range from decentralized finance (DeFi) platforms to decentralized exchanges and more.

-

Gas Fees: Ethereum operates on a proof-of-work consensus mechanism, which requires validators to solve complex mathematical puzzles to add new blocks to the blockchain. This process is known as mining, and it requires computational power. In return for their efforts, miners are rewarded with ETH. However, this process also generates gas fees, which are paid by users for executing transactions on the network.

Understanding Tether (USDT)

Tether is a stablecoin, which means it is designed to maintain a stable value relative to a fiat currency. Here are some key aspects of USDT:

-

Stable Value: Tether aims to maintain a value of $1 by being backed by fiat currencies, primarily the US dollar. This makes it a popular choice for users who want to avoid the volatility associated with other cryptocurrencies.

-

Use Cases: USDT is widely used for trading, as it provides a stable value that can be easily converted to other cryptocurrencies. It is also used for various financial services, including lending, borrowing, and payment processing.

-

Reserve Backing: Tether Limited claims that each USDT token is backed by a reserve of fiat currencies, which includes the US dollar, euros, and other currencies. However, there have been concerns about the transparency of these reserves, and the company has faced scrutiny from regulators.

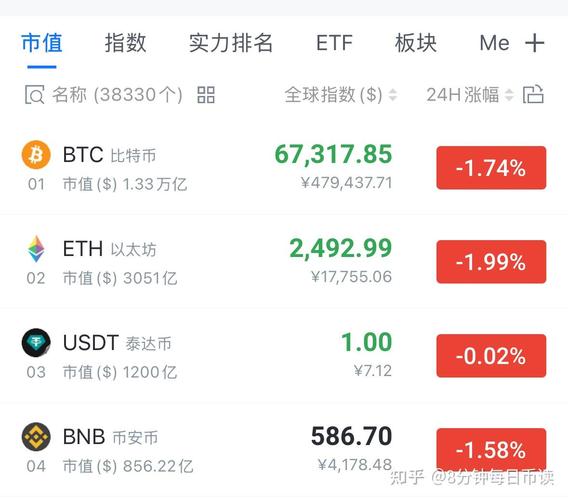

Comparison of ETH and USDT

While both ETH and USDT are popular cryptocurrencies, they serve different purposes and have distinct characteristics. Here is a comparison of the two:

| Feature | Ethereum (ETH) | Tether (USDT) |

|---|---|---|

| Functionality | Blockchain platform for smart contracts and DApps | Stablecoin backed by fiat currencies |

| Market Value | Varies based on supply and demand | Stable at $1 |

| Use Cases | Development of decentralized applications, investment, and trading | Trading, financial services, and payment processing |

Impact on the Market

Both ETH and USDT have had a significant impact on the cryptocurrency market. Here are some key points:

-

Ethereum: The introduction of smart contracts and DApps has revolutionized the way transactions are conducted. Ethereum has become