ETH 3k: A Comprehensive Overview

Are you intrigued by the potential of Ethereum reaching $3,000? If so, you’ve come to the right place. In this detailed exploration, we’ll delve into various aspects of this scenario, including market trends, technical analysis, and potential risks. Let’s embark on this journey together.

Market Trends

Understanding the current market trends is crucial when considering the possibility of Ethereum reaching $3,000. Here’s a breakdown of some key factors:

| Factor | Description |

|---|---|

| Adoption Rate | The increasing adoption of Ethereum across various industries, such as finance, gaming, and supply chain, has contributed to its growing demand. |

| Competitive Landscape | Ethereum’s competition with other blockchain platforms, such as Binance Smart Chain and Cardano, has driven innovation and improved its features. |

| Regulatory Environment | The regulatory landscape is evolving, with some countries embracing blockchain technology and cryptocurrencies, which could positively impact Ethereum’s price. |

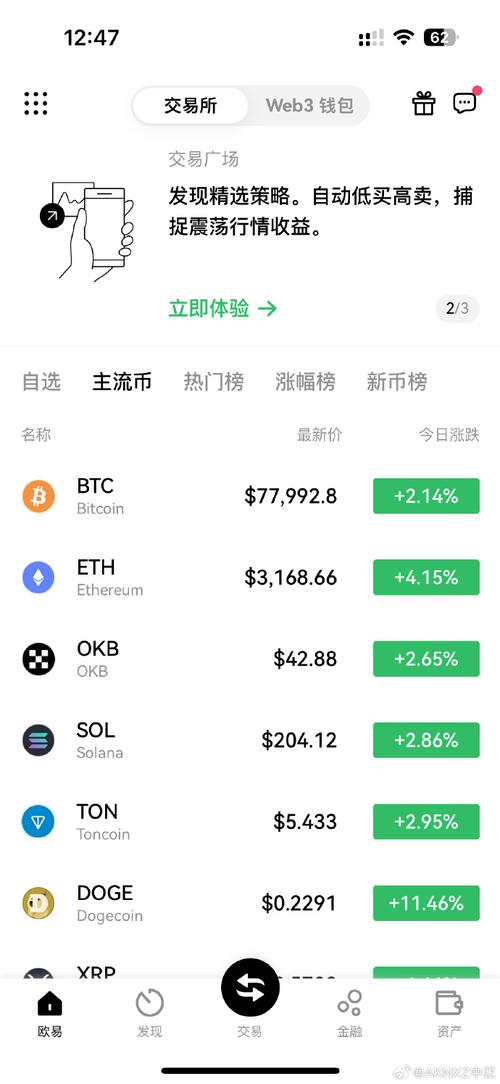

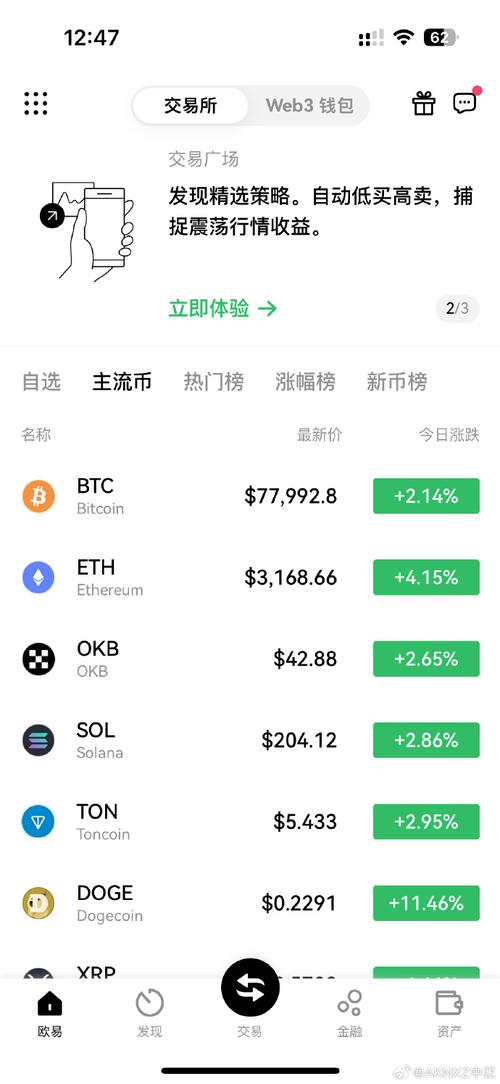

Technical Analysis

Technical analysis plays a significant role in predicting the price of cryptocurrencies. Let’s explore some key indicators that could suggest Ethereum reaching $3,000:

-

Market Cap: Ethereum’s market cap has been steadily increasing, indicating a growing demand for the asset.

-

Transaction Volume: The rising transaction volume on the Ethereum network suggests increased activity and interest in the platform.

-

Relative Strength Index (RSI): An RSI value above 70 indicates that Ethereum is overbought, which could lead to a price increase.

-

Volume Weighted Average Price (VWAP): The VWAP is a moving average that considers both price and volume, and a crossover above the VWAP could signal a potential price increase.

Factors Contributing to Ethereum’s Price Increase

Several factors could contribute to Ethereum reaching $3,000:

-

Ethereum 2.0 Upgrade: The upcoming Ethereum 2.0 upgrade is expected to improve scalability, reduce transaction fees, and increase network security, potentially attracting more users and investors.

-

Decentralized Finance (DeFi): The DeFi sector has seen significant growth, with many projects being built on the Ethereum platform. This has increased demand for ETH, as it is used as a transactional currency within the DeFi ecosystem.

-

Smart Contract Development: The increasing number of smart contracts being developed on Ethereum suggests a growing interest in decentralized applications, which could drive demand for ETH.

-

Institutional Interest: The growing interest from institutional investors in cryptocurrencies has the potential to drive up the price of Ethereum.

Risks and Challenges

While there are several factors that could contribute to Ethereum reaching $3,000, there are also risks and challenges to consider:

-

Market Volatility: The cryptocurrency market is known for its volatility, which could lead to significant price fluctuations.

-

Regulatory Risks: The regulatory landscape is still evolving, and any negative news or changes in regulations could impact the price of Ethereum.

-

Competition: The increasing competition from other blockchain platforms could lead to a loss of market share for Ethereum.

-

Security Concerns: Despite the advancements in security, Ethereum is not immune to hacking and other security threats.

Conclusion

While it’s difficult to predict the exact price of Ethereum in the future, considering the current market trends, technical analysis, and potential factors contributing to its price increase, reaching $3,000 seems plausible. However, it’s essential to be aware of the risks and challenges associated with investing in cryptocurrencies. As always, do your research and consult with a financial advisor before making any investment decisions.