Understanding the Basics

When diving into the world of cryptocurrencies, two names often stand out: Ethereum (ETH) and Bitcoin (BTC). These digital assets have revolutionized the financial landscape, and their charts have become a focal point for investors and enthusiasts alike. Let’s explore the history and characteristics of these two giants in the crypto space.

Bitcoin: The Pioneer

Bitcoin, launched in 2009, was the first decentralized cryptocurrency. Created by an anonymous entity or group known as Satoshi Nakamoto, Bitcoin introduced the concept of blockchain technology. Its chart history is marked by significant milestones, including its initial value of around $0.0008 per BTC, which has since skyrocketed to tens of thousands of dollars.

| Year | Bitcoin Price (USD) |

|---|---|

| 2009 | $0.0008 |

| 2010 | $0.003 |

| 2011 | $0.30 |

| 2012 | $5 |

| 2013 | $1,000 |

| 2017 | $20,000 |

| 2021 | $68,000 |

Ethereum: The Platform

Ethereum, launched in 2015 by Vitalik Buterin, is not just a cryptocurrency but a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). Its chart history has been equally impressive, with ETH prices soaring from just a few cents to over $4,000.

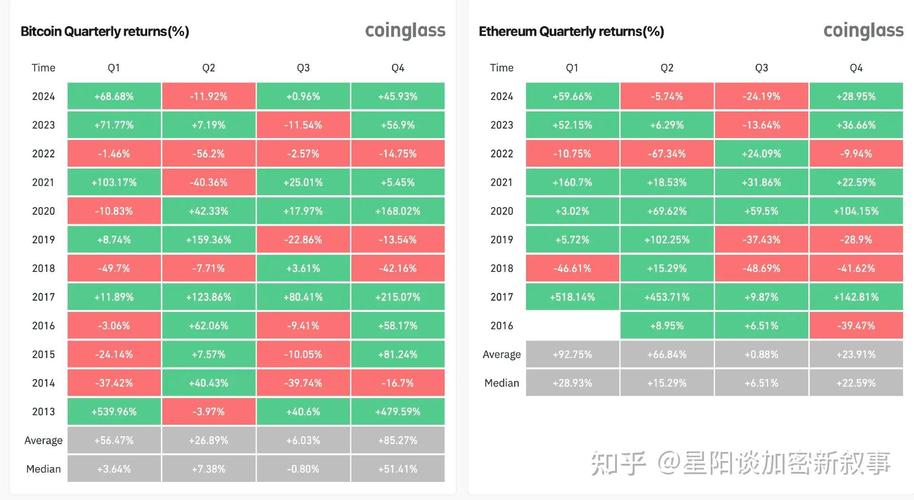

Comparing the Charts

When comparing the BTC and ETH charts, several key differences emerge. Bitcoin has maintained a more stable price over time, while Ethereum has experienced more volatility. This can be attributed to Bitcoin’s status as the leading cryptocurrency and its limited supply, which is capped at 21 million coins. On the other hand, Ethereum has a higher supply cap of 18 million coins, which may contribute to its more volatile price movements.

Market Dynamics

The market dynamics of both cryptocurrencies have been influenced by various factors, including regulatory news, technological advancements, and global economic events. For instance, the 2017 bull run saw both BTC and ETH reach all-time highs, driven by widespread interest in cryptocurrencies. However, regulatory news, such as China’s ban on mining and trading, has had a significant impact on the market, causing prices to fluctuate.

Technological Advancements

Both Bitcoin and Ethereum have seen technological advancements that have influenced their chart history. Bitcoin’s transition to the Lightning Network, a second-layer scaling solution, aims to improve its transaction speed and reduce fees. Ethereum, on the other hand, is transitioning to Ethereum 2.0, a major upgrade that will enhance its scalability and security.

Investment Opportunities

Investing in BTC and ETH offers unique opportunities and risks. Bitcoin is often considered a “digital gold,” providing a store of value and a hedge against inflation. Ethereum, on the other hand, is seen as a platform with vast potential for innovation and growth. Investors must weigh these factors when deciding which cryptocurrency to invest in.

Conclusion

Understanding the chart history of Bitcoin and Ethereum is crucial for anyone interested in the crypto space. Both cryptocurrencies have made significant strides in the past decade and continue to evolve. By analyzing their charts and market dynamics, investors can make informed decisions about their investments.