Understanding ETH, Crypto, and USD: A Comprehensive Guide for You

When it comes to the world of digital currencies, ETH, crypto, and USD are three terms that often come up. But what do they really mean, and how are they connected? In this detailed guide, we’ll explore each of these terms from different angles to give you a clearer understanding.

What is ETH?

ETH, short for Ethereum, is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It’s a cryptocurrency that runs on its own blockchain, separate from Bitcoin’s. Ethereum was created by Vitalik Buterin in 2015, and since then, it has become one of the most popular cryptocurrencies in the world.

One of the key features of Ethereum is its smart contract functionality. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. This allows for trustless transactions, as the code is immutable and can be verified by anyone. This has opened up a wide range of possibilities, from decentralized finance (DeFi) to supply chain management and more.

Understanding Crypto

Crypto, short for cryptocurrency, refers to digital or virtual currencies that use cryptography for security. Unlike traditional fiat currencies, cryptocurrencies are not controlled by any central authority, such as a government or central bank. Instead, they operate on decentralized networks, typically blockchain technology.

Cryptocurrencies have gained significant popularity over the years, with Bitcoin being the first and most well-known example. However, there are thousands of different cryptocurrencies, each with its own unique features and use cases. Some of the most popular cryptocurrencies, in addition to Bitcoin and Ethereum, include Bitcoin Cash, Litecoin, Ripple, and Cardano.

Crypto offers several advantages, such as lower transaction fees, faster transactions, and increased privacy. However, it also comes with its own set of risks, including price volatility and regulatory uncertainty.

The Role of USD

USD, short for United States Dollar, is the world’s most widely used fiat currency. It’s the official currency of the United States and is used in international trade and finance. USD is often referred to as the “reserve currency” because many countries hold significant amounts of USD in their foreign exchange reserves.

In the context of cryptocurrencies, USD plays a crucial role as a stable reference point. Many cryptocurrencies are priced in USD, and their value is often compared to the USD. This makes USD an important currency for investors and traders in the crypto market.

ETH, Crypto, and USD: How They Interact

Now that we have a basic understanding of ETH, crypto, and USD, let’s explore how they interact with each other.

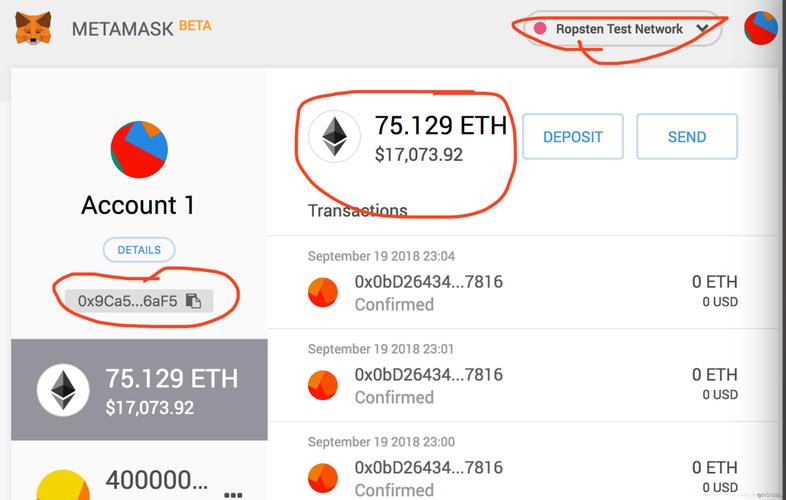

ETH is a type of crypto, and as such, it can be bought, sold, and traded using various crypto exchanges. When you purchase ETH, you’re essentially investing in the Ethereum platform and its potential for future growth.

Crypto, as a whole, can be bought and sold using fiat currencies like USD. Many exchanges allow users to trade cryptocurrencies for USD, which can then be used to purchase other cryptocurrencies or fiat currencies. This makes USD a key currency in the crypto market.

When you’re looking at the value of ETH or any other cryptocurrency, you’ll often see it priced in USD. This allows for easy comparison and understanding of the cryptocurrency’s value relative to the world’s most widely used fiat currency.

Table: Comparison of ETH, Crypto, and USD

| Aspect | ETH | Crypto | USD |

|---|---|---|---|

| Type | Cryptocurrency | Category | Fiat Currency |

| Blockchain | Ethereum | Decentralized | Centralized |

| Usage | Smart contracts, DApps | Investment, transactions | International trade, finance |

| Value | Priced in USD | Varies by cryptocurrency | Stable reference point |

Understanding the relationship between ETH,