15.5 ETH: A Comprehensive Overview

Are you considering investing in Ethereum (ETH) but find yourself overwhelmed by the vast amount of information available? Look no further! In this detailed guide, we’ll delve into the various aspects of 15.5 ETH, providing you with a comprehensive overview to help you make an informed decision.

Understanding Ethereum

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. The native cryptocurrency of the Ethereum network is ETH, which is used to pay for transaction fees and as a store of value.

Market Analysis

As of the latest data available, the price of ETH is fluctuating within a range of $1,800 to $2,200. To understand the potential of 15.5 ETH, let’s take a look at the market analysis.

| Market Cap | Price | Market Dominance |

|---|---|---|

| $200 billion | $1,900 | 18.5% |

With a market cap of $200 billion, Ethereum is the second-largest cryptocurrency by market value, trailing only Bitcoin. Its market dominance stands at 18.5%, which means it holds a significant position in the crypto market.

Investment Potential

When considering an investment in 15.5 ETH, it’s essential to analyze the potential returns. Let’s explore some factors that can influence the investment potential:

1. Market Trends

Historically, Ethereum has shown significant growth, with its price increasing from $0.30 in 2015 to over $4,800 in 2021. However, it’s crucial to note that the crypto market is highly volatile, and prices can fluctuate rapidly.

2. Network Development

Ethereum is continuously evolving, with ongoing developments such as Ethereum 2.0, which aims to improve scalability and reduce transaction fees. These advancements can positively impact the value of ETH.

3. Adoption Rate

The adoption rate of Ethereum as a platform for DApps and smart contracts is increasing. As more businesses and individuals adopt Ethereum, the demand for ETH may rise, potentially leading to higher prices.

Risks and Considerations

While investing in 15.5 ETH can be lucrative, it’s essential to be aware of the risks involved:

1. Market Volatility

The crypto market is known for its high volatility, which can lead to significant price fluctuations. It’s crucial to be prepared for both ups and downs in the market.

2. Regulatory Risks

Regulatory authorities around the world are still figuring out how to regulate cryptocurrencies. Changes in regulations can impact the value of ETH and the overall crypto market.

3. Security Risks

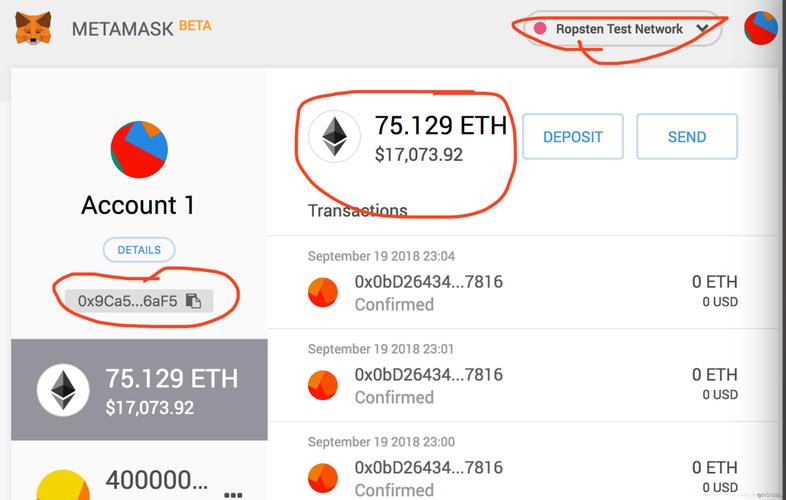

As with any digital asset, there are security risks associated with storing and transferring ETH. It’s essential to use secure wallets and follow best practices to protect your investment.

Conclusion

Investing in 15.5 ETH can be a lucrative opportunity, but it’s crucial to conduct thorough research and understand the risks involved. By considering market trends, network development, and adoption rate, you can make a more informed decision. Remember to stay updated with the latest news and developments in the crypto market to stay ahead of potential opportunities and risks.