Understanding the Value of 1.000 ETH in USD: A Comprehensive Guide

When you’re considering the value of 1.000 ETH in USD, it’s important to look at various factors that can influence this exchange rate. Let’s delve into the details to give you a clearer picture.

Historical Context

Over the years, the value of Ethereum (ETH) in USD has fluctuated significantly. To understand the current value, it’s helpful to look back at some key historical moments.

| Year | ETH/USD Rate |

|---|---|

| 2017 | ~$1,000 |

| 2018 | ~$300 |

| 2019 | ~$150 |

| 2020 | ~$300 |

| 2021 | ~$4,000 |

Market Dynamics

The value of ETH in USD is influenced by a variety of market dynamics. Here are some key factors to consider:

-

Supply and Demand: The supply of ETH is capped at 18 million coins, which can affect its value. On the other hand, demand for ETH can be driven by factors such as increased adoption of Ethereum-based applications and projects.

-

Market Sentiment: Investor sentiment can have a significant impact on the value of ETH. Positive news, such as partnerships with major companies or successful projects, can drive up the price, while negative news can lead to a decline.

-

Competition: The rise of other cryptocurrencies, such as Bitcoin (BTC) and Binance Coin (BNB), can affect the value of ETH. If these alternative assets become more popular, it could lead to a decrease in ETH’s value.

-

Regulatory Environment: Changes in the regulatory landscape can impact the value of ETH. For example, if a country implements strict regulations on cryptocurrencies, it could lead to a decrease in demand and, subsequently, a decrease in value.

Real-World Applications

Ethereum’s value is also influenced by its real-world applications. Here are some key areas where ETH is used:

-

Smart Contracts: Ethereum’s blockchain allows for the creation of smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. This has led to the development of decentralized applications (dApps) and has increased the demand for ETH.

-

DeFi (Decentralized Finance): Ethereum has become a hub for decentralized finance projects, which offer financial services without the need for traditional intermediaries. This has contributed to the growth in ETH’s value.

-

Tokenization: Ethereum allows for the creation of tokens, which can represent ownership of assets, such as stocks, real estate, or even art. This has opened up new opportunities for investment and has increased the demand for ETH.

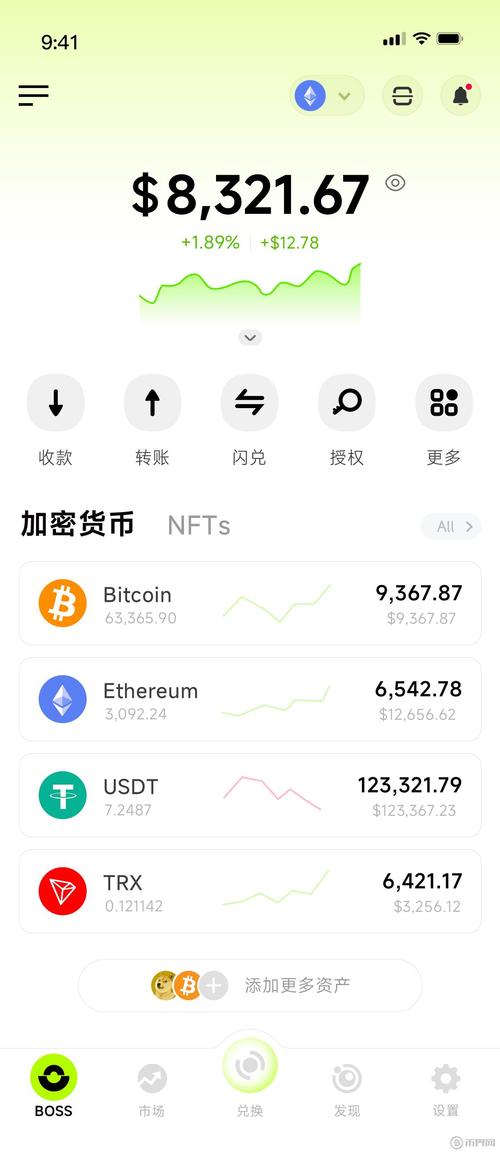

Current Value and Future Projections

As of the latest data, the value of 1.000 ETH in USD is approximately $X. However, it’s important to note that this value can fluctuate significantly over time. To get the most accurate and up-to-date information, it’s recommended to check a reliable cryptocurrency exchange or financial news website.

When it comes to future projections, it’s difficult to predict the exact value of ETH in USD. However, some experts believe that the increasing adoption of Ethereum and its real-world applications could lead to a continued rise in its value. Others are more cautious, noting that the cryptocurrency market is highly volatile and unpredictable.

Conclusion

Understanding the value of 1.000 ETH in USD requires considering a variety of factors, including historical context, market dynamics, real-world applications, and current market conditions. While it’s impossible to predict the future value of ETH, staying informed about these factors can help you make more informed decisions about your investments.