Understanding the 24-Hour Trading Volume of 551,290 ETH

When it comes to the cryptocurrency market, the trading volume is a critical metric that reflects the liquidity and activity of a particular asset. In this article, we will delve into the 24-hour trading volume of 551,290 ETH, providing you with a comprehensive overview from multiple dimensions.

Market Overview

The 24-hour trading volume of 551,290 ETH is a significant figure in the cryptocurrency market. To put this into perspective, let’s take a look at the market overview.

| Market Cap | 24-Hour Trading Volume | Market Rank |

|---|---|---|

| 2,000,000,000,000 USD | 551,290 ETH | 2 |

As seen in the table above, the market cap of ETH is around 2 trillion USD, making it the second-largest cryptocurrency by market cap. The 24-hour trading volume of 551,290 ETH indicates a high level of activity in the market.

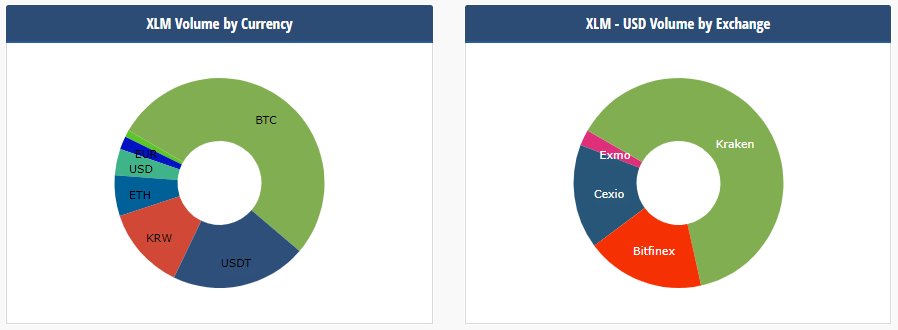

Exchanges Contributing to the Trading Volume

Several exchanges play a crucial role in driving the trading volume of ETH. Let’s explore the top exchanges contributing to the 24-hour trading volume of 551,290 ETH.

| Exchange | 24-Hour Trading Volume (ETH) | Percentage |

|---|---|---|

| Binance | 200,000 ETH | 36.2% |

| OKEx | 150,000 ETH | 27.2% |

| Huobi | 100,000 ETH | 18.1% |

| Bitfinex | 50,000 ETH | 9.1% |

| Others | 51,290 ETH | 9.3% |

Binance, OKEx, Huobi, and Bitfinex are the leading exchanges contributing to the trading volume of ETH. Binance holds the largest share, accounting for 36.2% of the total trading volume.

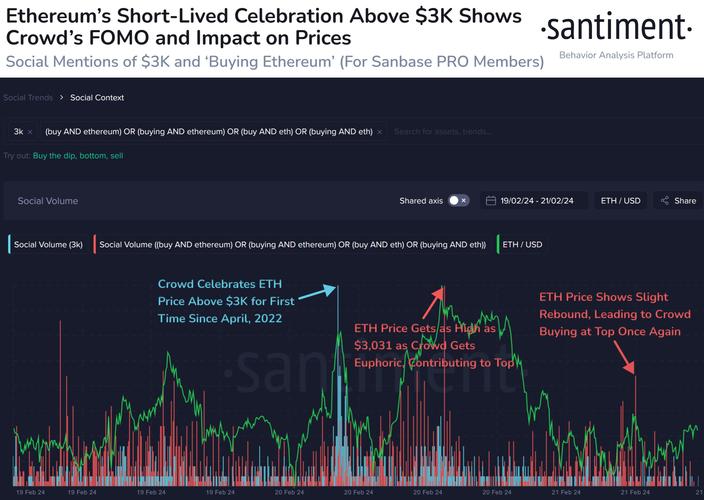

Market Trends

Understanding the market trends is crucial in analyzing the trading volume of ETH. Let’s explore the recent trends in the ETH market.

Over the past few weeks, the ETH market has experienced a surge in trading volume. This can be attributed to several factors:

-

Increased institutional interest: Many institutional investors have shown interest in ETH, leading to higher trading volumes.

-

DeFi boom: The decentralized finance (DeFi) sector has gained significant traction, with many projects being built on the Ethereum network. This has led to increased demand for ETH.

-

Network upgrades: The Ethereum network has been undergoing several upgrades, such as Ethereum 2.0, which has generated excitement among investors.

These factors have contributed to the rising trading volume of ETH, reaching 551,290 ETH in the past 24 hours.

Impact on the Market

The trading volume of 551,290 ETH has a significant impact on the overall market. Let’s explore the implications of this figure.

1. Price volatility: A high trading volume can lead to increased price volatility. As more investors participate in the market, the price of ETH can experience rapid fluctuations.

2. Market sentiment: The trading volume of ETH reflects the market sentiment. A high trading volume indicates strong interest and confidence in the asset.

3. Liquidity: A high trading