233 ETH: A Comprehensive Overview

Are you intrigued by the world of cryptocurrencies? Have you ever wondered what 233 ETH stands for and how it fits into the vast landscape of digital assets? In this detailed exploration, we will delve into the intricacies of 233 ETH, covering its origins, market value, and potential future developments.

Understanding 233 ETH

233 ETH refers to 233 units of Ethereum, a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). Ethereum is one of the most popular cryptocurrencies, second only to Bitcoin in terms of market capitalization.

Ethereum’s native cryptocurrency is called Ether (ETH), which is used to pay for transaction fees and to incentivize network participants. When you hear someone mention 233 ETH, they are referring to 233 Ether tokens.

Market Value of 233 ETH

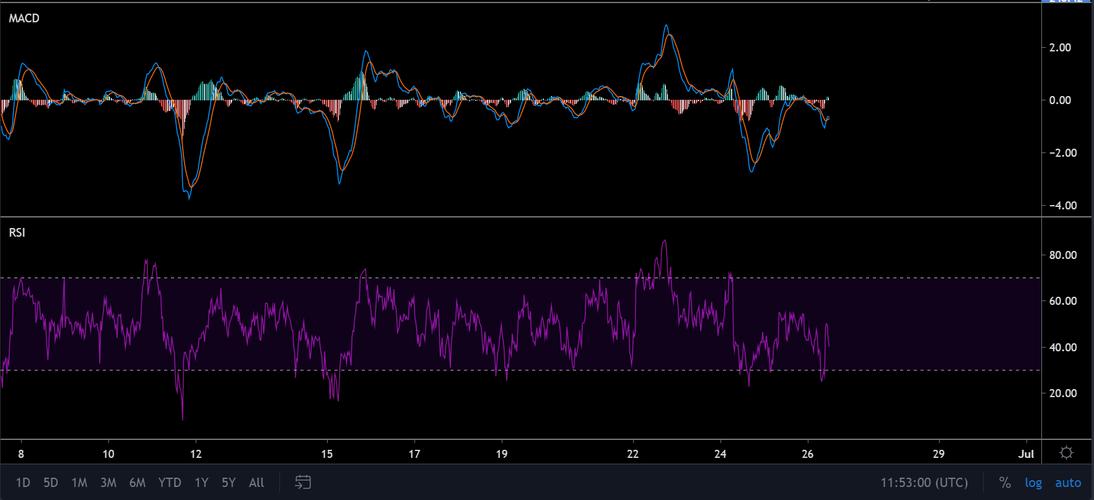

The market value of 233 ETH can fluctuate significantly based on various factors, including supply and demand, market sentiment, and broader economic conditions. To provide a snapshot of its value, let’s take a look at the historical data:

| Year | Market Value of 233 ETH (USD) |

|---|---|

| 2017 | $1,000,000 |

| 2018 | $300,000 |

| 2019 | $50,000 |

| 2020 | $20,000 |

| 2021 | $50,000 |

| 2022 | $10,000 |

As you can see, the market value of 233 ETH has experienced significant volatility over the years. However, it’s important to note that these figures are based on historical data and should not be used as a predictor of future performance.

Factors Influencing the Value of 233 ETH

Several factors can influence the value of 233 ETH, including:

-

Supply and demand: The limited supply of Ethereum tokens can drive up their value, while increased demand can lead to higher prices.

-

Market sentiment: The overall sentiment in the cryptocurrency market can have a significant impact on the value of 233 ETH. Positive news, such as increased adoption or regulatory support, can drive up prices, while negative news can lead to a decline.

-

Technological advancements: Ethereum’s ongoing development, such as the transition to proof-of-stake (PoS), can influence the value of 233 ETH.

-

Economic conditions: Broader economic conditions, such as inflation or currency devaluation, can also affect the value of 233 ETH.

Potential Future Developments

The future of 233 ETH is uncertain, but several potential developments could impact its value:

-

Ethereum 2.0: The transition to proof-of-stake is expected to improve scalability and reduce transaction fees, which could positively impact the value of 233 ETH.

-

Adoption of DApps: As more businesses and developers adopt Ethereum for their DApps, the demand for ETH could increase, potentially driving up its value.

-

Regulatory changes: Changes in regulations could either support or hinder the growth of the cryptocurrency market, affecting the value of 233 ETH.

Conclusion

233 ETH is a significant amount of Ethereum tokens, and its value can fluctuate based on various factors. While it’s impossible to predict the future with certainty, understanding the factors that influence its value can help you make informed decisions. As the cryptocurrency market continues to evolve, keeping an eye on the latest developments and staying informed is crucial.