Understanding the Value of 1.189 ETH

Have you ever wondered what 1.189 ETH is worth in today’s market? As the cryptocurrency world continues to evolve, understanding the value of different digital assets becomes increasingly important. In this article, we’ll delve into the details of 1.189 ETH, exploring its potential, historical performance, and future prospects.

Market Performance

As of the latest data available, 1.189 ETH is a relatively small amount of Ethereum. However, its value can fluctuate significantly based on market conditions. To get a better understanding of its worth, let’s take a look at the historical performance of ETH.

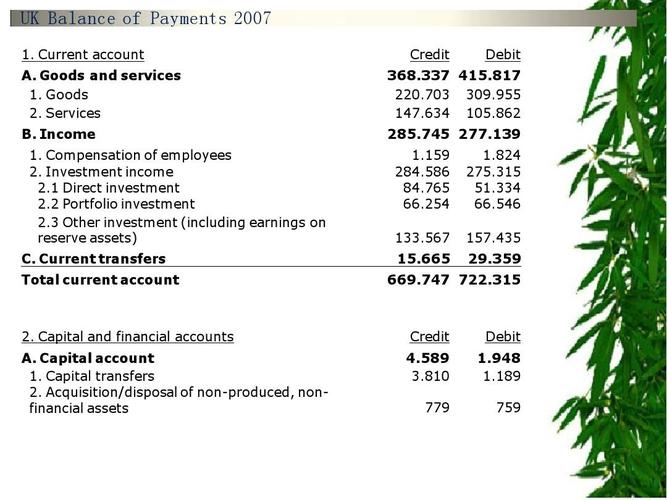

| Year | ETH Price | Change from Previous Year |

|---|---|---|

| 2017 | $1,200 | 900% |

| 2018 | $140 | -88% |

| 2019 | $250 | 78% |

| 2020 | $600 | 140% |

| 2021 | $4,000 | 566% |

As you can see from the table, ETH has experienced significant volatility over the years. In 2017, the price skyrocketed, reaching an all-time high of $1,200. However, it faced a major downturn in 2018, falling to $140. Since then, it has recovered and reached new heights, with a price of $4,000 in 2021.

Factors Influencing ETH Price

Several factors can influence the price of ETH, including market sentiment, regulatory news, technological advancements, and overall economic conditions. Here are some key factors to consider:

-

Market Sentiment: The cryptocurrency market is highly speculative, and investor sentiment can have a significant impact on prices. Positive news, such as increased adoption or partnerships, can drive prices up, while negative news, such as regulatory crackdowns or security breaches, can lead to declines.

-

Regulatory News: Governments around the world are still figuring out how to regulate cryptocurrencies. Any news regarding regulatory changes can have a significant impact on ETH prices.

-

Technological Advancements: The Ethereum network is constantly evolving, with new updates and improvements being made regularly. These advancements can increase the value of ETH and drive demand for the cryptocurrency.

-

Economic Conditions: The global economy can also influence ETH prices. For example, during times of economic uncertainty, investors may turn to cryptocurrencies as a safe haven, driving up prices.

Future Prospects

Looking ahead, the future of ETH is uncertain, but there are several factors that could contribute to its growth:

-

Ethereum 2.0: The upcoming Ethereum 2.0 upgrade is expected to improve the network’s scalability, security, and efficiency. This could lead to increased adoption and demand for ETH.

-

Decentralized Finance (DeFi): DeFi has become a major driver of ETH demand, as it allows users to access financial services without intermediaries. As DeFi continues to grow, so too could ETH’s value.

-

Smart Contracts: ETH is the native token of the Ethereum network, which is widely used for creating and deploying smart contracts. As the demand for smart contracts increases, so too could ETH’s value.

While there are many potential factors that could contribute to the growth of ETH, it’s important to remember that the cryptocurrency market is highly speculative and unpredictable. As with any investment, it’s crucial to do your own research and consider your risk tolerance before investing in ETH or any other cryptocurrency.