Understanding the Ethereum (ETH) Market on May 9th

As of May 9th, the Ethereum (ETH) market has been experiencing a mix of trends and indicators that traders and investors should be aware of. Let’s delve into the details to gain a comprehensive understanding of the current situation.

Market Overview

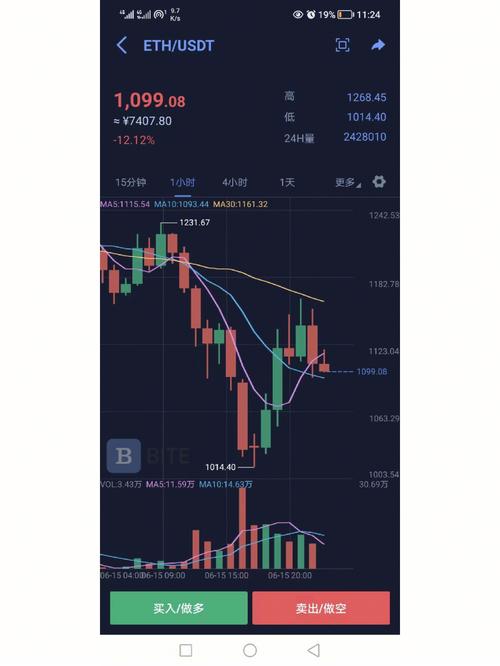

The Ethereum market has been on a rollercoaster ride lately, with prices fluctuating significantly. As of May 9th, the ETH price has been hovering around $1,800, showing a slight downward trend from its recent highs.

Technical Analysis

Looking at the technical analysis, several key indicators can provide insights into the market’s direction:

| Indicator | Analysis |

|---|---|

| MACD | The MACD (Moving Average Convergence Divergence) indicator shows a bearish trend, with the signal line crossing below the histogram, suggesting a potential downward movement in the market. |

| RSI | The Relative Strength Index (RSI) is currently at 38, indicating that the market is neither overbought nor oversold. This suggests that the market may remain range-bound in the short term. |

| EMA | The Exponential Moving Averages (EMA) are showing a downward trend, with the 50-day EMA crossing below the 200-day EMA, indicating a bearish outlook for the market. |

Market Sentiment

Market sentiment has been mixed, with some traders remaining cautious due to the bearish technical indicators, while others are optimistic about the long-term potential of Ethereum.

One key factor influencing market sentiment is the upcoming Ethereum 2.0 upgrade, which is expected to improve scalability and efficiency. This has led some investors to believe that Ethereum has a bright future and is worth holding for the long term.

Key Levels to Watch

Traders should keep an eye on the following key levels in the Ethereum market:

- Support Level: $1,700 – This is a crucial level to watch, as a breakdown below this level could lead to further downward momentum.

- Resistance Level: $1,900 – This is a significant resistance level that traders will be watching closely for potential price movements.

Trading Strategies

Based on the current market conditions, here are some trading strategies to consider:

- Short-term Trading: Traders can consider taking short positions near the resistance level of $1,900, with a stop-loss set above the level. This strategy is suitable for those looking to capitalize on short-term price movements.

- Long-term Investment: Investors with a long-term perspective can consider buying Ethereum near the support level of $1,700, as this could represent a good entry point for the long term.

Risks and Considerations

It’s important to note that trading cryptocurrencies involves risks, and traders should always conduct thorough research and consider their own risk tolerance before making investment decisions.

Additionally, traders should be aware of the volatility in the market and be prepared to adjust their strategies accordingly.

In conclusion, the Ethereum market on May 9th presents a complex mix of technical indicators, market sentiment, and key levels to watch. By understanding these factors, traders and investors can make informed decisions and potentially capitalize on the market’s movements.