Understanding the 50 ETH Price: A Comprehensive Guide

Are you curious about the current value of 50 ETH? In this detailed guide, we will delve into the various factors that influence the price of Ethereum, how it compares to other cryptocurrencies, and what you can expect in the future. Whether you’re a seasoned investor or just dipping your toes into the crypto market, this article will provide you with the knowledge you need to make informed decisions.

What is Ethereum (ETH)?

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. The native cryptocurrency of the Ethereum network is called Ether (ETH), which is used to pay for transaction fees and execute smart contracts.

Understanding the 50 ETH Price

The price of 50 ETH can be influenced by several factors, including market demand, supply, technological advancements, regulatory news, and macroeconomic trends. Let’s explore these factors in more detail.

Market Demand and Supply

Like any other asset, the price of 50 ETH is determined by the basic economic principle of supply and demand. When demand for ETH increases, its price tends to rise, and vice versa. Factors that can affect demand include:

- Investor sentiment: Positive news about Ethereum or the broader crypto market can boost investor confidence and drive up demand.

- Adoption of DApps: The growth of decentralized applications on the Ethereum network can increase demand for ETH as users need to pay for transaction fees.

- Market competition: The rise of alternative blockchains and cryptocurrencies can impact the demand for ETH.

On the supply side, the Ethereum network has a maximum supply of 18 million ETH. The supply of ETH is controlled through a process called mining, where miners validate transactions and add new blocks to the blockchain. As of now, the supply of ETH is increasing at a rate of approximately 4.5% per year.

Technological Advancements

Ethereum’s price can also be influenced by technological advancements within the network. Some key developments that can impact the price of 50 ETH include:

- Ethereum 2.0: The transition to Ethereum 2.0, which aims to improve scalability, security, and sustainability, can positively impact the price of ETH.

- Sharding: Sharding is a technology that will enable the Ethereum network to process more transactions per second, potentially increasing its adoption and value.

- Layer 2 solutions: Layer 2 solutions, such as Optimism and Arbitrum, are designed to improve the scalability of the Ethereum network and may increase its value.

Regulatory News

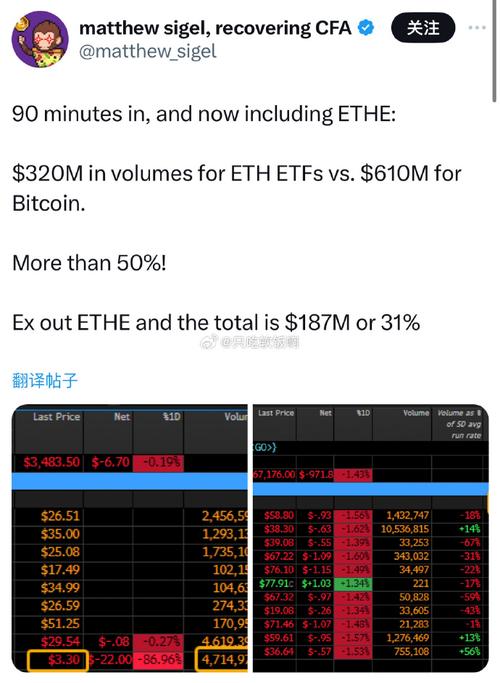

Regulatory news can have a significant impact on the price of 50 ETH. For example, if a country announces strict regulations on cryptocurrencies, it could lead to a decrease in demand for ETH. Conversely, positive regulatory news, such as the approval of a cryptocurrency exchange-traded fund (ETF), could boost investor confidence and drive up the price of ETH.

Macroeconomic Trends

The price of 50 ETH can also be influenced by macroeconomic trends, such as inflation, interest rates, and currency fluctuations. For instance, if the value of the US dollar decreases, it could make ETH more attractive to investors, leading to an increase in its price.

Comparing 50 ETH to Other Cryptocurrencies

When comparing the price of 50 ETH to other cryptocurrencies, it’s essential to consider factors such as market capitalization, trading volume, and adoption rates. Here’s a brief comparison of 50 ETH to some of the top cryptocurrencies:

| Cryptocurrency | Market Capitalization | Trading Volume | Adoption Rate |

|---|---|---|---|

| BTC | $1.1 trillion | $30 billion | High |

| ETH | $200 billion | $10 billion | High |

| BNB | $100 billion | $5 billion

|