Understanding the Value of 1.41 ETH

When it comes to the world of cryptocurrencies, the value of a single unit can vary greatly depending on various factors. In this article, we delve into the intricacies surrounding 1.41 ETH, exploring its significance, potential growth, and the factors that influence its value.

What is ETH?

ETH, or Ethereum, is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). It is the second-largest cryptocurrency by market capitalization, trailing only Bitcoin. ETH serves as the native currency of the Ethereum network and is used to pay for transaction fees and execute smart contracts.

Historical Price of ETH

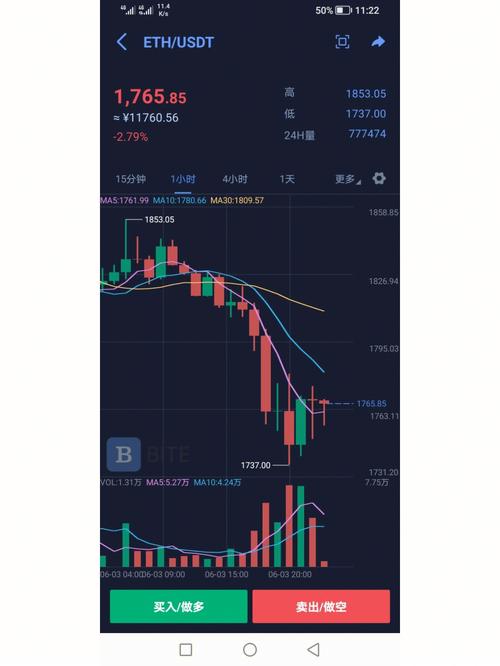

The price of ETH has experienced significant volatility over the years. As of the time of writing, the historical price of ETH can be summarized as follows:

| Year | Price (USD) |

|---|---|

| 2015 | ~$0.31 |

| 2016 | ~$0.60 |

| 2017 | ~$730 |

| 2018 | ~$85 |

| 2019 | ~$130 |

| 2020 | ~$730 |

| 2021 | ~$4,382 |

Factors Influencing ETH Price

Several factors contribute to the fluctuation in the price of ETH:

-

Market Supply and Demand: The supply of ETH is capped at 18 million coins, which creates scarcity and can drive up prices.

-

Regulatory Environment: Changes in government regulations can impact the demand for ETH and its price.

-

Technological Developments: Innovations in the Ethereum network, such as the transition to Ethereum 2.0, can influence investor confidence and drive price increases.

-

Market Sentiment: The overall sentiment in the cryptocurrency market can affect ETH prices, as investors often react to news and trends.

Potential Growth of ETH

Many experts predict that ETH will continue to grow in value over the long term. Some of the reasons for this optimism include:

-

Ethereum 2.0 Transition: The transition to Ethereum 2.0 is expected to improve scalability, reduce transaction fees, and increase network security, which could attract more users and investors.

-

DeFi and DApps: The rise of decentralized finance (DeFi) and the increasing number of DApps on the Ethereum network are expected to drive demand for ETH.

-

Adoption by Institutions: As institutional investors become more comfortable with cryptocurrencies, they may increase their holdings of ETH, further driving up demand and prices.

1.41 ETH: What Does It Mean?

With the current price of ETH hovering around $1,400, owning 1.41 ETH is a significant amount. This amount could be used to purchase goods and services, invest in other cryptocurrencies, or simply hold as a long-term investment.

Conclusion

Understanding the value of 1.41 ETH requires considering its historical price, the factors that influence its value, and the potential for future growth. While the cryptocurrency market is unpredictable, many experts believe that ETH has a bright future and could continue to increase in value over time.