1.75 ETH: A Comprehensive Overview

Are you considering investing in Ethereum (ETH) but unsure about the potential of 1.75 ETH? Look no further! This article delves into the multifaceted aspects of owning 1.75 ETH, providing you with a detailed and reliable guide.

Understanding Ethereum

Ethereum, often abbreviated as ETH, is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). Launched in 2015 by Vitalik Buterin, Ethereum has become one of the most popular cryptocurrencies in the market.

The Value of 1.75 ETH

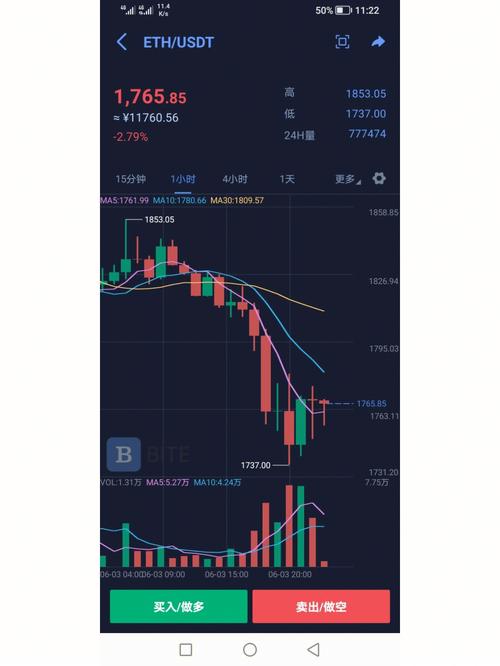

As of the latest data available, the value of 1.75 ETH can vary significantly depending on the current market conditions. To give you a better understanding, let’s take a look at the historical price of ETH:

| Year | Price of 1 ETH (USD) |

|---|---|

| 2015 | $0.30 |

| 2016 | $8.00 |

| 2017 | $1,200.00 |

| 2018 | $300.00 |

| 2019 | $150.00 |

| 2020 | $600.00 |

| 2021 | $4,000.00 |

| 2022 | $2,000.00 |

Based on this data, the value of 1.75 ETH can range from approximately $2,700 to $3,500, depending on the current market conditions. However, it’s important to note that cryptocurrency markets are highly volatile, and prices can fluctuate rapidly.

Investment Opportunities

Investing in 1.75 ETH opens up various opportunities, including:

-

Participation in the Ethereum network: By owning ETH, you become a part of the Ethereum network, contributing to its decentralization and security.

-

Smart contract development: Ethereum’s platform allows developers to create and deploy smart contracts, which can be used for a wide range of applications, such as decentralized finance (DeFi), supply chain management, and more.

-

Staking rewards: Ethereum’s upcoming upgrade to Proof of Stake (PoS) will enable users to earn rewards by staking their ETH. Owning 1.75 ETH could potentially make you eligible for staking rewards once the upgrade is implemented.

-

Participation in governance: Ethereum’s community actively participates in the governance of the network. By owning ETH, you can vote on important decisions affecting the platform’s future.

Risks and Considerations

While investing in 1.75 ETH offers numerous opportunities, it’s crucial to be aware of the risks involved:

-

Market volatility: Cryptocurrency markets are known for their high volatility, which can lead to significant price fluctuations in a short period of time.

-

Regulatory risks: Governments around the world are still figuring out how to regulate cryptocurrencies, which can lead to sudden changes in the market.

-

Security risks: As with any digital asset, there is always a risk of theft or loss due to hacks or human error.

Conclusion

Investing in 1.75 ETH can be a rewarding experience, but it’s important to do thorough research and understand the risks involved. By staying informed and making informed decisions, you can maximize your chances of success in the Ethereum ecosystem.