Best ETH Base for Fortitude: A Comprehensive Guide

When it comes to investing in Ethereum (ETH), finding the right base for fortitude is crucial. Fortitude, in this context, refers to the resilience and stability of your investment. In this detailed guide, we will explore various aspects of Ethereum that can serve as a solid foundation for your investment strategy.

Understanding Ethereum’s Market Dynamics

Ethereum, as a decentralized platform, has seen significant growth over the years. To build a robust base for fortitude, it’s essential to understand the market dynamics that drive its value. Here’s a breakdown of some key factors:

| Factor | Description |

|---|---|

| Supply and Demand | The balance between the number of ETH in circulation and the demand for it can significantly impact its price. |

| Network Activity | High levels of network activity, such as transactions and smart contracts, can indicate a strong ecosystem. |

| Regulatory Environment | Changes in the regulatory landscape can have a profound impact on the adoption and value of ETH. |

| Technological Advancements | Innovations in Ethereum’s technology, such as the upcoming Ethereum 2.0 upgrade, can drive long-term growth. |

By keeping an eye on these factors, you can better understand the market dynamics and make informed decisions about your investment strategy.

Choosing the Right Exchange

Selecting the right exchange is crucial for building a strong base for fortitude. Here are some key considerations:

- Security: Ensure the exchange has robust security measures, such as two-factor authentication and cold storage for funds.

- Reputation: Research the exchange’s reputation and user reviews to ensure it’s a reliable platform.

- Fee Structure: Compare the fees charged by different exchanges to find the most cost-effective option.

- Available Markets: Look for an exchange that offers a wide range of trading pairs, including ETH.

Some popular exchanges for Ethereum include Coinbase, Binance, and Kraken. Each has its own strengths and weaknesses, so it’s essential to choose the one that best suits your needs.

Storing Your ETH Securely

Storing your ETH securely is crucial for maintaining its value. Here are some options to consider:

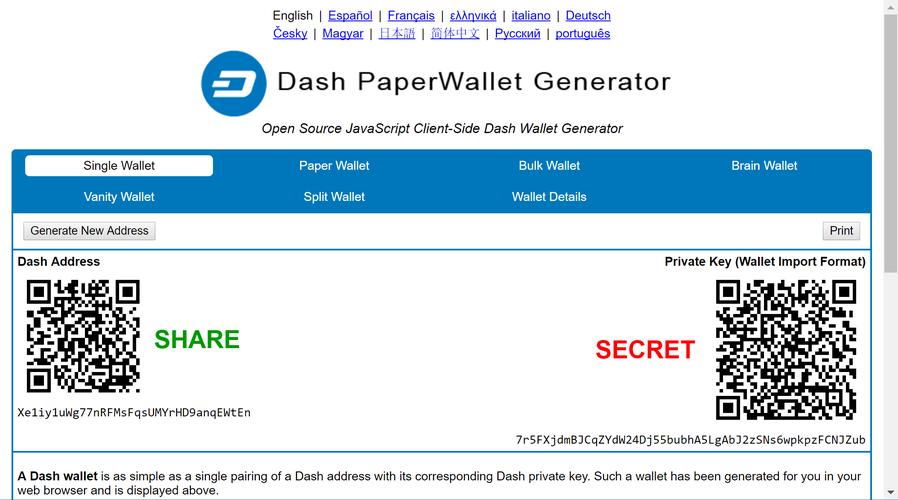

- Cold Storage: Cold storage involves keeping your ETH offline, which significantly reduces the risk of theft. Hardware wallets, such as Ledger Nano S and Trezor, are popular choices.

- Mobile Wallets: Mobile wallets offer convenience but may be less secure than cold storage options. Be cautious when choosing a mobile wallet and ensure it has strong security features.

- Web Wallets: Web wallets are accessible online but can be more vulnerable to hacking. Use them only for small amounts of ETH and ensure the wallet is reputable.

It’s essential to research and choose the storage method that best suits your needs and risk tolerance.

Building a Diversified Portfolio

A diversified portfolio can help mitigate risks and increase the likelihood of long-term success. Here are some strategies to consider:

- Invest in Other Cryptocurrencies: Consider adding other cryptocurrencies to your portfolio, such as Bitcoin, Litecoin, or Cardano, to diversify your risk.

- Invest in Altcoins: Altcoins, or alternative cryptocurrencies, can offer additional growth opportunities. However, be cautious and research each coin thoroughly before investing.

- Invest in Traditional Assets: Including traditional assets, such as stocks and bonds, can help balance your portfolio and reduce risk.

Remember that diversification does not guarantee profits, but it can help protect your investment from significant losses.