Understanding the 529 ETH: A Comprehensive Guide

Are you intrigued by the world of cryptocurrencies and looking to dive into the specifics of 529 ETH? Well, you’ve come to the right place. In this detailed guide, we’ll explore what 529 ETH is, its significance, and how it fits into the broader landscape of digital currencies.

What is 529 ETH?

529 ETH refers to a specific amount of Ethereum, a popular cryptocurrency. Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It’s often referred to as the “second-largest cryptocurrency” after Bitcoin, with a market capitalization that fluctuates based on supply and demand.

Understanding Ethereum’s Role

Ethereum’s primary purpose is to facilitate the execution of smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. This technology has paved the way for a wide range of applications, from decentralized finance (DeFi) to supply chain management and more.

Why 529 ETH Matters

529 ETH is a significant amount of Ethereum, especially considering the volatile nature of the cryptocurrency market. It’s often used as a benchmark for understanding the value of Ethereum and its potential for growth. Here are a few reasons why 529 ETH matters:

| Reason | Description |

|---|---|

| Market Capitalization | 529 ETH represents a substantial portion of Ethereum’s market capitalization, making it a significant indicator of the cryptocurrency’s value. |

| Investment Potential | For investors, 529 ETH can serve as a valuable investment, with the potential for significant returns if the market continues to grow. |

| Transaction Volume | 529 ETH can be used to facilitate transactions on the Ethereum network, contributing to the overall activity and liquidity of the platform. |

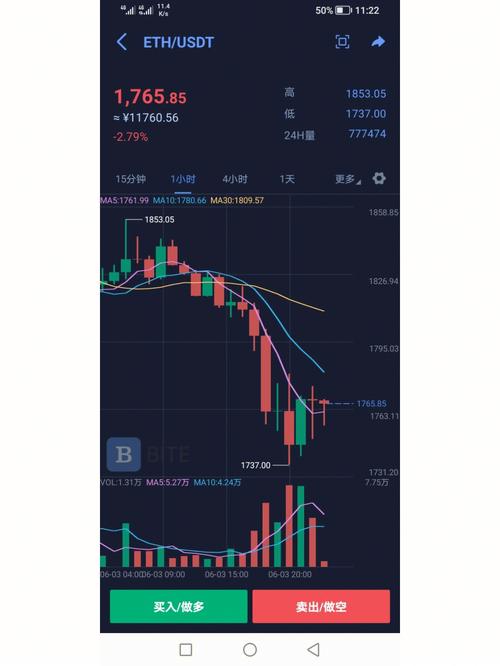

Factors Influencing 529 ETH’s Value

Like all cryptocurrencies, the value of 529 ETH is influenced by a variety of factors. Here are some of the key factors that can impact its value:

-

Market Supply and Demand: The supply of Ethereum is capped at 18 million coins, which can affect its value based on market demand.

-

Technological Developments: Innovations and improvements in Ethereum’s technology can positively impact its value.

-

Regulatory Environment: Changes in the regulatory landscape can have a significant impact on the value of cryptocurrencies.

-

Economic Factors: Global economic conditions, such as inflation and currency fluctuations, can influence the value of 529 ETH.

How to Obtain 529 ETH

There are several ways to obtain 529 ETH:

-

Buying on a Cryptocurrency Exchange: You can purchase Ethereum on various exchanges, such as Coinbase, Binance, or Kraken.

-

Staking: Staking Ethereum can earn you additional ETH through the process of validating transactions on the network.

-

Participating in ICOs: Investing in initial coin offerings (ICOs) can provide you with ETH in exchange for your investment.

Conclusion

529 ETH is a significant amount of Ethereum, with various implications for investors and the broader cryptocurrency market. By understanding its role, the factors influencing its value, and how to obtain it, you can make informed decisions about your investment in this digital asset.