Understanding Ethereum (ETH) and Avalanche (AVAX): A Comprehensive Guide

Ethereum (ETH) and Avalanche (AVAX) are two of the most prominent cryptocurrencies in the blockchain space. Both offer unique features and advantages, making them popular choices for investors and developers. In this article, we will delve into the details of both cryptocurrencies, covering their history, technology, market performance, and future prospects.

History and Background

Ethereum, launched in 2015, was one of the first blockchain platforms to introduce smart contracts. It has since become the leading platform for decentralized applications (dApps) and decentralized finance (DeFi) projects. Avalanche, on the other hand, was launched in 2020 and aims to provide a more scalable and efficient alternative to Ethereum.

Technology and Architecture

Ethereum operates on a proof-of-work (PoW) consensus mechanism, which requires significant computational power to secure the network. AVAX, however, uses a unique proof-of-stake (PoS) consensus mechanism called the Avalanche consensus protocol, which is designed to be more energy-efficient and scalable.

| Feature | Ethereum (ETH) | Avalanche (AVAX) |

|---|---|---|

| Consensus Mechanism | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Transaction Speed | 15-30 seconds | 1-3 seconds |

| Transaction Fees | Varies | Low |

| Scalability | Limited | High |

Market Performance

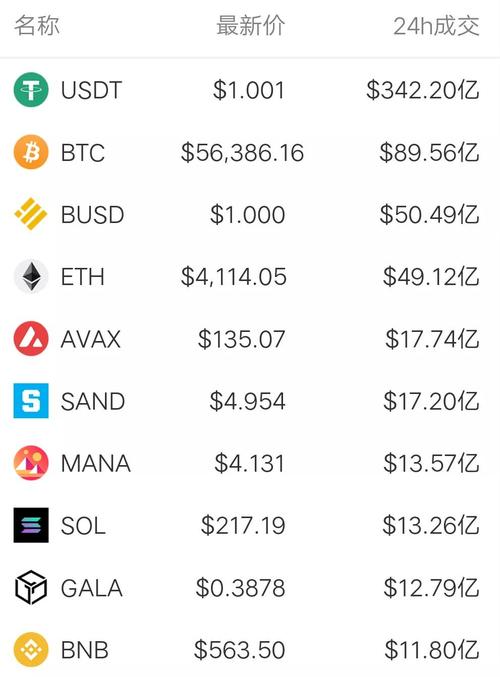

Both ETH and AVAX have experienced significant growth since their inception. Ethereum has been the dominant player in the smart contract space, with a market capitalization of over $200 billion. Avalanche, while younger, has also seen impressive growth, with a market capitalization of over $20 billion.

Over the past few years, Ethereum has faced challenges related to scalability and high transaction fees. This has led to the rise of alternative platforms like Avalanche, which offer faster transaction speeds and lower fees. As a result, both cryptocurrencies have seen increased interest from investors and developers.

Use Cases and Applications

Ethereum is widely used for dApps, DeFi projects, and NFTs. Its platform supports a wide range of applications, from simple dApps to complex financial instruments. Avalanche, on the other hand, is gaining traction in the DeFi and NFT spaces, thanks to its high throughput and low transaction fees.

Some popular use cases for Ethereum include:

- Decentralized finance (DeFi) applications, such as lending platforms, stablecoins, and exchanges.

- Non-fungible tokens (NFTs), which are unique digital assets representing ownership of digital art, music, and other collectibles.

- Smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code.

Some popular use cases for Avalanche include:

- DeFi applications, such as lending platforms, stablecoins, and exchanges.

- NFTs, which are unique digital assets representing ownership of digital art, music, and other collectibles.

- Custom blockchain networks, which can be created using the Avalanche platform.

Future Prospects

The future of both Ethereum and Avalanche looks promising. Ethereum is working on its Ethereum 2.0 upgrade, which aims to address scalability and sustainability issues. Avalanche, on the other hand, continues to gain traction in the DeFi and NFT spaces, with more projects being built on its platform.

As the blockchain space continues to evolve, both ETH and AVAX are well-positioned to play a significant role in the future of decentralized technology. Whether you are an investor or a developer, understanding the nuances of these two cryptocurrencies can help you make informed decisions.