Eth CME Chart: A Comprehensive Guide to Understanding Ethereum’s Future

When it comes to the world of cryptocurrencies, Ethereum (ETH) stands out as one of the most influential and widely-traded digital assets. One of the key platforms where traders and investors can track and trade ETH is the Chicago Mercantile Exchange (CME). In this article, we’ll delve into the details of the ETH/CME chart, exploring its significance, how to read it, and what it reveals about Ethereum’s future.

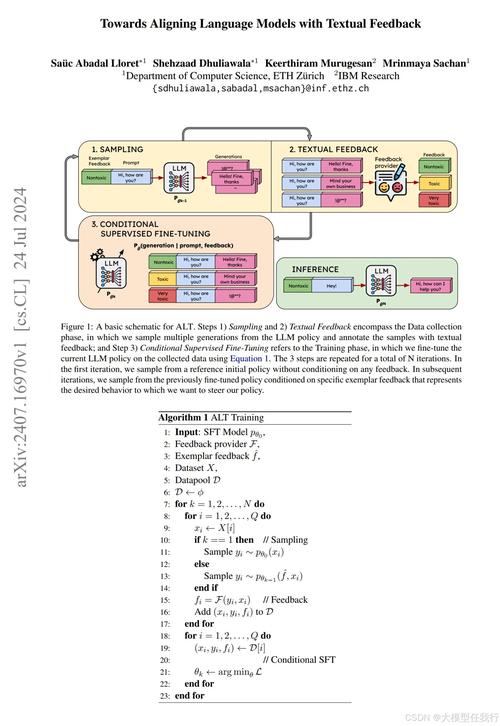

Understanding the ETH/CME Chart

The ETH/CME chart is a financial tool that displays the price of Ethereum in relation to the CME futures contract. This chart is crucial for traders and investors as it provides insights into the market sentiment and potential price movements of ETH. Let’s break down the key components of this chart:

| Component | Description |

|---|---|

| Price | The current market price of ETH in relation to the CME futures contract. |

| Volume | The total number of ETH being traded on the CME platform. |

| Open Interest | The total number of futures contracts that are currently open. |

| Historical Data | Information on past price movements, volume, and open interest. |

By analyzing these components, you can gain a better understanding of the market dynamics and make informed trading decisions.

Reading the ETH/CME Chart

Reading the ETH/CME chart involves understanding various technical indicators and patterns. Here are some essential elements to consider:

-

Trend Lines: These lines connect the highs and lows of the chart, helping you identify the overall trend of ETH. Uptrend lines indicate a bullish market, while downtrend lines suggest a bearish market.

-

Support and Resistance Levels: These levels represent price points where the market has repeatedly struggled to move above (resistance) or below (support). Traders often look for opportunities to enter or exit positions at these levels.

-

Volume: High volume often indicates significant interest in a particular price level, suggesting potential price movements.

-

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide additional insights into the market’s direction.

By combining these elements, you can develop a comprehensive understanding of the ETH/CME chart and make more informed trading decisions.

Interpreting the ETH/CME Chart for Future Price Movements

The ETH/CME chart can offer valuable insights into the future price movements of Ethereum. Here are some key factors to consider:

-

Market Sentiment: The chart can help you gauge the overall market sentiment towards ETH. A strong bullish trend may indicate a positive outlook, while a bearish trend may suggest a negative sentiment.

-

Historical Price Patterns: Analyzing past price patterns can provide clues about future price movements. For example, a chart that shows a series of higher highs and higher lows may indicate a strong bullish trend.

-

News and Events: Keep an eye on news and events related to Ethereum and the broader cryptocurrency market. These factors can significantly impact the price of ETH.

-

Fundamental Analysis: Consider the fundamental factors that drive the demand and supply of ETH, such as network adoption, technological advancements, and regulatory news.

By combining the insights from the ETH/CME chart with these factors, you can develop a more accurate prediction of Ethereum’s future price movements.

Conclusion

The ETH/CME chart is a powerful tool for traders and investors looking to understand the market dynamics and potential price movements of Ethereum. By analyzing the chart’s components, reading technical indicators, and considering various factors, you can make more informed trading decisions. Keep in mind that the cryptocurrency market is highly volatile, so always do your research and consult with a financial