Understanding the ETH Calculator Price: A Comprehensive Guide

Are you curious about the price of Ethereum (ETH) and how it’s calculated? Look no further! In this detailed guide, we’ll delve into the various factors that influence the ETH calculator price, providing you with a comprehensive understanding of how this cryptocurrency’s value is determined.

What is the ETH Calculator Price?

The ETH calculator price refers to the current market value of one Ethereum unit. It is a dynamic figure that fluctuates based on supply and demand, as well as other external factors. To calculate the ETH price, we need to consider several key components.

Market Supply and Demand

One of the most fundamental factors affecting the ETH calculator price is the balance between supply and demand. When demand for ETH increases, its price tends to rise, and vice versa. This relationship is similar to that of other commodities and financial assets.

Supply is determined by the total number of ETH tokens in circulation, which is capped at 21 million. Demand, on the other hand, is influenced by various factors, such as the adoption of Ethereum-based applications, the growth of the DeFi sector, and the overall sentiment in the cryptocurrency market.

Market Capitalization

Market capitalization is another crucial factor in determining the ETH calculator price. It represents the total value of all ETH tokens in circulation and is calculated by multiplying the current price by the total supply. A higher market capitalization typically indicates a more significant presence in the cryptocurrency market, which can positively impact the ETH price.

| Market Capitalization | ETH Price | Total Supply |

|---|---|---|

| $200 billion | $2,000 | 10 million |

| $300 billion | $3,000 | 10 million |

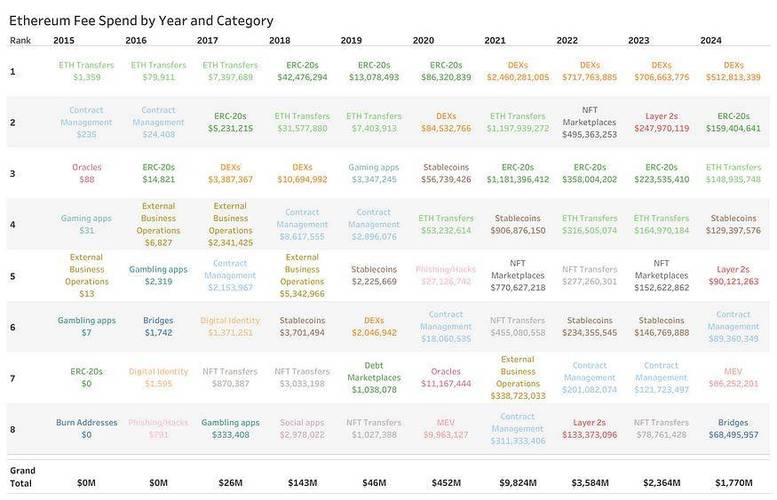

Transaction Fees and Gas Prices

ETH is used as a transactional currency on the Ethereum network. When users make transactions, they pay gas fees, which are paid in ETH. The gas price is determined by the network’s congestion and the complexity of the transaction. Higher gas prices can lead to increased demand for ETH, potentially affecting its price.

Market Sentiment and News

Market sentiment and news can have a significant impact on the ETH calculator price. Positive news, such as partnerships, regulatory approvals, or technological advancements, can boost the price, while negative news, such as regulatory crackdowns or security breaches, can lead to a decline in value.

Market Trends and Historical Data

Understanding market trends and historical data can help you make more informed decisions about the ETH calculator price. By analyzing past price movements, you can identify patterns and potential future trends. However, it’s important to note that the cryptocurrency market is highly volatile, and past performance is not always indicative of future results.

Conclusion

In conclusion, the ETH calculator price is influenced by a variety of factors, including market supply and demand, market capitalization, transaction fees, gas prices, market sentiment, and news. By understanding these factors, you can gain a better grasp of how the ETH price is determined and make more informed decisions about your investments.