Understanding the ETH vs BTC Dominance Chart: A Comprehensive Guide

When diving into the world of cryptocurrencies, one of the most crucial metrics to track is the dominance of major digital assets. The ETH vs BTC dominance chart is a vital tool for investors, traders, and enthusiasts alike. This guide will delve into the intricacies of this chart, exploring its significance, how it’s calculated, and its implications for the crypto market.

What is the ETH vs BTC Dominance Chart?

The ETH vs BTC dominance chart compares the market capitalization of Ethereum (ETH) to that of Bitcoin (BTC). It’s a percentage that indicates the relative size of each cryptocurrency in the overall market. For instance, if the chart shows ETH dominance at 50%, it means that ETH and BTC are equally valued in the market. Conversely, if BTC dominance is at 70%, it means that Bitcoin’s market capitalization is 70% of the total crypto market cap.

How is the ETH vs BTC Dominance Calculated?

The dominance of ETH and BTC is calculated using the following formula:

| Component | Description |

|---|---|

| Market Capitalization of ETH | The total value of all ETH in circulation, multiplied by its current price. |

| Market Capitalization of BTC | The total value of all BTC in circulation, multiplied by its current price. |

| Market Capitalization of Total Crypto Market | The total value of all cryptocurrencies in circulation, multiplied by their respective prices. |

Once you have the market capitalizations, you can calculate the dominance as follows:

ETH Dominance = (Market Capitalization of ETH / Market Capitalization of Total Crypto Market) 100

BTC Dominance = (Market Capitalization of BTC / Market Capitalization of Total Crypto Market) 100

Implications of the ETH vs BTC Dominance Chart

The ETH vs BTC dominance chart can provide valuable insights into the crypto market’s dynamics. Here are some key implications:

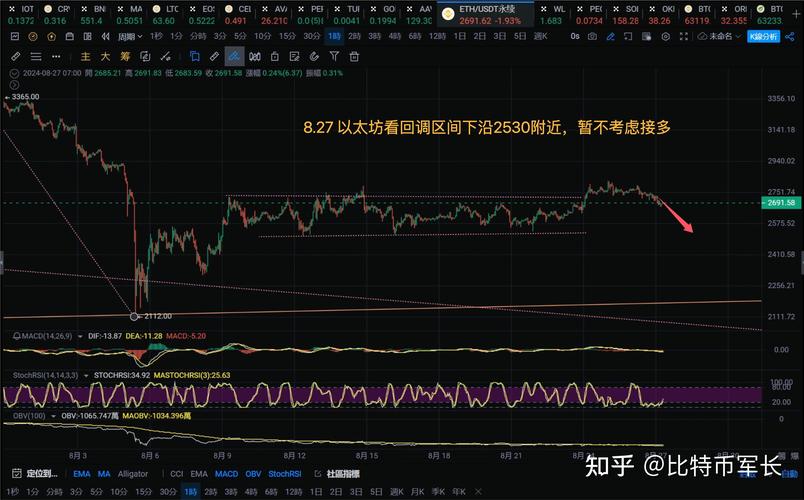

Market Sentiment

When ETH dominance is high, it often indicates that investors are bullish on Ethereum and believe it has the potential to outperform Bitcoin. Conversely, when BTC dominance is high, it suggests that investors are confident in Bitcoin’s long-term prospects and view it as a safer bet.

Market Trends

By analyzing the ETH vs BTC dominance chart over time, you can identify trends and patterns. For example, if the chart shows a consistent rise in ETH dominance, it may indicate a growing interest in Ethereum-based projects and decentralized finance (DeFi). On the other hand, a rising BTC dominance might suggest a shift towards traditional finance (TradFi) or a preference for Bitcoin’s perceived stability.

Market Manipulation

It’s essential to be aware of potential market manipulation when interpreting the ETH vs BTC dominance chart. Large investors or whales can influence the chart by buying or selling large amounts of ETH or BTC, which can lead to misleading signals.

Conclusion

The ETH vs BTC dominance chart is a powerful tool for understanding the crypto market’s dynamics. By analyzing this chart, you can gain insights into market sentiment, trends, and potential manipulation. However, it’s crucial to consider other factors, such as individual cryptocurrency fundamentals and overall market conditions, when making investment decisions.