Eth Coin Market Cap: A Comprehensive Overview

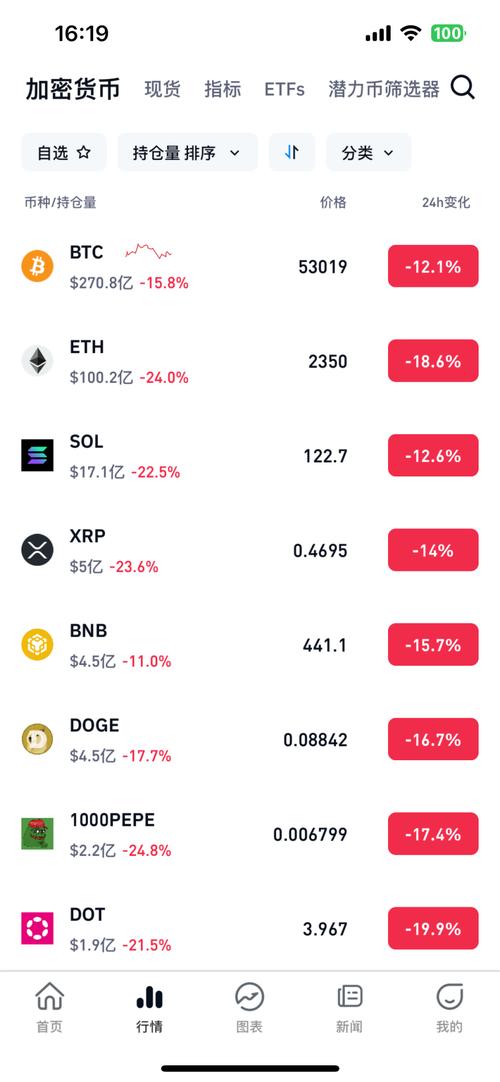

Understanding the market capitalization of Ethereum, often referred to as “Eth Coin Market Cap,” is crucial for anyone interested in the cryptocurrency space. This figure represents the total value of all Ethereum tokens in circulation and is a key indicator of the asset’s market standing. Let’s delve into the various aspects that make up the Ethereum market capitalization.

What is Ethereum Market Capitalization?

Ethereum market capitalization is the total value of all Ethereum tokens currently in circulation. It is calculated by multiplying the current price of Ethereum by the total number of Ethereum tokens in existence. This figure is constantly changing as the price of Ethereum fluctuates and new tokens are created or destroyed through mining activities.

How is Ethereum Market Capitalization Calculated?

The calculation of Ethereum market capitalization is straightforward. You take the current price of Ethereum, which can be found on various cryptocurrency exchanges, and multiply it by the total supply of Ethereum tokens. The total supply includes both the tokens that have been mined and those that are yet to be released, such as those locked in smart contracts.

| Component | Description |

|---|---|

| Current Price | The current market price of one Ethereum token. |

| Total Supply | The total number of Ethereum tokens in circulation. |

| Market Capitalization | The product of the current price and total supply. |

Factors Influencing Ethereum Market Capitalization

Several factors can influence the market capitalization of Ethereum. Here are some of the key drivers:

-

Supply and Demand: Like any other asset, the price of Ethereum is influenced by the basic economic principle of supply and demand. An increase in demand for Ethereum can lead to a rise in its price, thereby increasing its market capitalization.

-

Network Activity: The level of activity on the Ethereum network, such as the number of transactions and smart contracts deployed, can also impact its market capitalization. A more active network is often seen as a positive sign, potentially leading to increased demand and higher prices.

-

Regulatory Environment: The regulatory landscape can significantly affect the market capitalization of Ethereum. Positive regulatory news can boost investor confidence, while negative news can lead to a sell-off and a decrease in market capitalization.

-

Competition: The rise of other blockchain platforms and cryptocurrencies can impact Ethereum’s market capitalization. If a new platform offers superior features or attracts more users, it could potentially reduce Ethereum’s market share.

-

Technological Developments: Ethereum’s ongoing development, including upgrades and new features, can influence its market capitalization. For example, the Ethereum 2.0 upgrade, which aims to improve scalability and reduce costs, has been eagerly anticipated by investors.

Ethereum Market Capitalization Over Time

Ethereum’s market capitalization has seen significant fluctuations since its inception. Here’s a brief overview of its journey:

-

2015-2016: Ethereum was relatively unknown, and its market capitalization was relatively low.

-

2017: Ethereum experienced a massive surge in popularity, leading to a significant increase in its market capitalization.

-

2018: The cryptocurrency market faced a bearish trend, and Ethereum’s market capitalization decreased accordingly.

-

2019-2020: Ethereum recovered and reached new all-time highs, with its market capitalization surpassing $200 billion.

-

2021: Ethereum continued to grow, with its market capitalization reaching over $400 billion.

Conclusion

Ethereum’s market capitalization is a critical indicator of its standing in the cryptocurrency market. By understanding the factors that influence it and its historical performance, you can gain valuable insights into the potential future of Ethereum. As the cryptocurrency landscape continues to evolve, keeping an eye on Ethereum’s market capitalization