Understanding ETH Approval ETF: A Comprehensive Guide

Are you considering investing in an Ethereum (ETH) Approval ETF? If so, you’ve come to the right place. In this detailed guide, we’ll explore what an ETH Approval ETF is, its benefits, risks, and how it compares to other investment options. Let’s dive in.

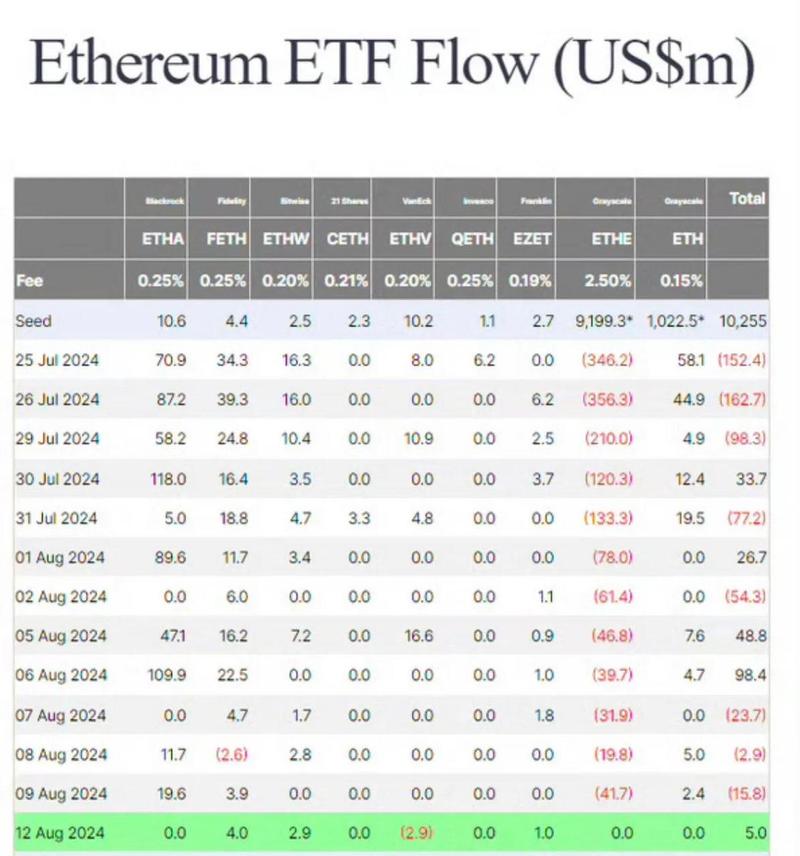

What is an ETH Approval ETF?

An ETH Approval ETF is a type of exchange-traded fund (ETF) that tracks the price of Ethereum. It allows investors to gain exposure to the cryptocurrency market without having to directly purchase and store ETH. These ETFs are designed to provide a more accessible and regulated way to invest in Ethereum.

How Does an ETH Approval ETF Work?

ETH Approval ETFs work by pooling investors’ money and using it to purchase a basket of Ethereum assets. These assets can include actual ETH, futures contracts, or other financial instruments that derive their value from Ethereum. The ETF then trades on a stock exchange, allowing investors to buy and sell shares of the ETF just like they would with any other stock.

Here’s a simplified breakdown of the process:

| Step | Description |

|---|---|

| 1 | Investors purchase shares of the ETH Approval ETF on a stock exchange. |

| 2 | The ETF uses the funds from investors to purchase Ethereum assets. |

| 3 | The ETF holds these assets and tracks the price of Ethereum. |

| 4 | Investors can buy and sell shares of the ETF on the stock exchange. |

Benefits of Investing in an ETH Approval ETF

Investing in an ETH Approval ETF offers several advantages:

- Accessibility: It allows investors to gain exposure to Ethereum without the need for a cryptocurrency wallet or understanding of blockchain technology.

- Regulation: ETFs are regulated by financial authorities, providing a level of security and transparency that may not be available with direct cryptocurrency investments.

- Liquidity: Shares of the ETF can be bought and sold on a stock exchange, offering liquidity and the ability to enter or exit the investment quickly.

- Cost-Effective: ETFs often have lower fees compared to other investment vehicles, such as mutual funds or individual cryptocurrency trading.

Risks of Investing in an ETH Approval ETF

While investing in an ETH Approval ETF has its benefits, it’s important to be aware of the risks:

- Crypto Market Volatility: Ethereum, like other cryptocurrencies, is known for its high volatility. This can lead to significant price swings, both up and down.

- Regulatory Risk: Changes in regulations regarding cryptocurrencies can impact the value of the ETF and its ability to operate.

- Liquidity Risk: While ETFs are generally liquid, during periods of market stress, there may be a lack of buyers, leading to wider bid-ask spreads.

Comparing ETH Approval ETFs to Other Investment Options

When considering an ETH Approval ETF, it’s helpful to compare it to other investment options:

- Cryptocurrency Exchanges: Directly purchasing and selling Ethereum on a cryptocurrency exchange offers more control and potentially higher returns. However, it also requires a cryptocurrency wallet and a deeper understanding of the market.

- Bitcoin ETFs: Bitcoin ETFs are similar to ETH Approval ETFs but track the price of Bitcoin instead. They offer the same benefits and risks but with a different underlying asset.

- Stocks and Bonds: Traditional investments like stocks and bonds are generally less volatile than cryptocurrencies but offer lower potential returns. They also provide a level of diversification that may be beneficial for risk-averse investors.

Conclusion

Investing in an ETH Approval ETF can be a great way to gain exposure to the Ethereum market without the complexities of direct cryptocurrency investment. However, it’s important to understand the risks and compare it to other investment options before