469 ETH: A Comprehensive Overview

Are you considering investing in Ethereum (ETH)? If so, you’ve come to the right place. In this article, we’ll delve into the details of 469 ETH, exploring its potential, risks, and what it could mean for your investment portfolio.

Understanding Ethereum

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference. It’s the second-largest cryptocurrency by market capitalization, after Bitcoin.

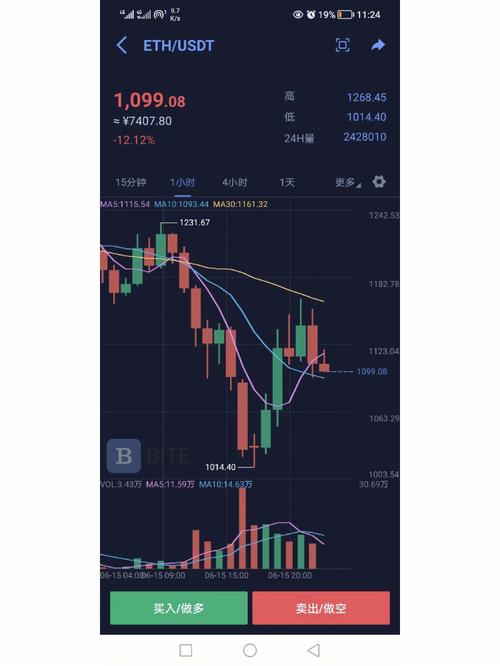

Market Capitalization and Price

As of the latest data available, the market capitalization of Ethereum is approximately $200 billion. The price of ETH has fluctuated significantly over the years, reaching an all-time high of around $4,800 in 2021. However, it’s important to note that the price of ETH can be highly volatile.

| Year | Market Capitalization (USD) | Price of ETH (USD) |

|---|---|---|

| 2017 | $1.1 billion | $13.50 |

| 2018 | $18.5 billion | $1,300 |

| 2019 | $25 billion | $190 |

| 2020 | $150 billion | $600 |

| 2021 | $200 billion | $4,800 |

Investment Potential

Investing in 469 ETH can offer several potential benefits:

-

Long-term growth: Ethereum has the potential to grow significantly over time, especially as more businesses and developers adopt its platform.

-

Dividends: Ethereum doesn’t offer dividends like traditional stocks, but its price can increase over time, providing a return on investment.

-

Decentralization: Ethereum’s decentralized nature means that it’s not subject to the same risks as traditional financial systems, such as bank failures or government intervention.

Risks to Consider

While investing in 469 ETH can be lucrative, it’s important to be aware of the risks involved:

-

Market volatility: The price of ETH can be highly volatile, leading to significant gains or losses in a short period of time.

-

Regulatory risks: Cryptocurrency regulations are still evolving, and changes in regulations could impact the value of ETH.

-

Security risks: While Ethereum is generally secure, there’s always a risk of hacks or other security breaches.

How to Invest in 469 ETH

Investing in 469 ETH involves several steps:

-

Choose a cryptocurrency exchange: There are many exchanges available, so it’s important to choose one that is reputable and offers the features you need.

-

Set up an account: Once you’ve chosen an exchange, you’ll need to set up an account and verify your identity.

-

Deposit funds: You’ll need to deposit funds into your exchange account to purchase ETH.

-

Purchase ETH: Once you have funds in your account, you can purchase ETH using your preferred payment method.

-

Store your ETH: It’s important to store your ETH in a secure wallet to protect it from theft or loss.

Conclusion

Investing in 469 ETH can be a wise decision, but it’s important to do your research and understand the risks involved. By considering the potential benefits and risks, and following the steps outlined above,